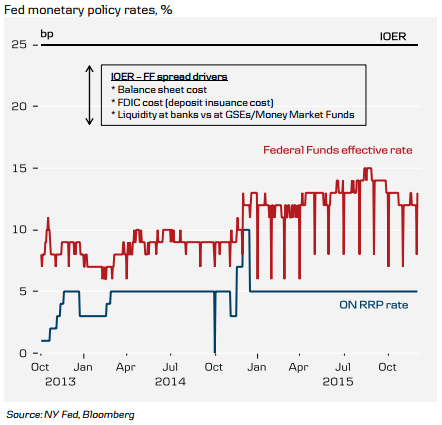

The U.S. Federal Reserve is holding more bonds; as a result, total USD reserves in the Fed funds system have increased to USD 2,500 billion, which is more than reserve requirement. The depository institutes, who have reserve accounts with the Fed, are earning the interest rate on excess reserve (IOER) at 0.25%.

The Fed rate hike may increase a scope for the depository institutes to arbitrage out the spread between Fed fund rate and the IOER. They will barrow in the Fed funds market and save in IOER. Therefore, Fed should fix the funds rate at a margin to the IOER, suggests Danske Bank.

Higher Fed funds rate may raise arbitrage

Tuesday, December 8, 2015 5:12 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons