US nonfarm payrolls increased by 211k in November, surpassing consensus expectations for a rise of 200k. Adding to the positive tone of the report, the respective figures of September and October were revised higher by 35k cumulatively, with the three-month moving average increasing to 218k from 199k previously. The increase in nonfarm payrolls in November was mainly driven by the private sector, which rose by 197k.

Civilian household employment gained 244k, while the civilian labor force rebounded by +273k with the participation rate rising one-tenth to 62.5% in November. As a result, the unemployment rate remained unchanged at a 7 ½ year low of 5.0%. As was in the case in payroll growth, a strong acceleration in employment over the last couple of months has offset weak readings registered in the July to September period.

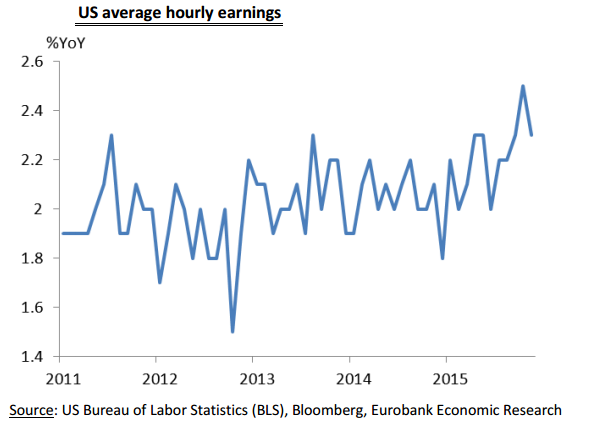

Average hourly earnings increased by 0.2%MoM in November, in line with consensus estimates, from 0.4%MoM in the prior month, with the annual rate of growth declining to 2.3% from 2.5% in October. Meanwhile, the average workweek was unchanged at 34.5 hours. The above mentioned slowing in the average hourly earnings growth is likely due to base effects and does not mark a decelerating trend in wage growth. Looking ahead, wage growth is expected to continue its upward trend and the US labor market to tighten further, exerting upward pressure on US inflation dynamics.

Significant gains in Wall Street followed the solid employment data on Friday, which increased confidence for a resilient US domestic economy against a soft global growth environment. Mirroring the uptrend in the US equity market, most European bourses rebounded on Monday, after their worst week in about almost four months. In FX markets, the US dollar rose against its major currency peers for the second consecutive session, as better-than-expected US labor market data reinforced expectations for a fed funds rate hike at next week's FOMC meeting, with the DXY index increasing 0.5% compared to Friday's settlement to 98.812 in early European trade. Against this background, the EUR/USD edged down 0.6% to 1.0814/15 at the time of writing, from a one-month high of 1.0981 hit in last Thursday's intraday trade.

Market participants expect a 25bps increase in the fed funds range to 25-50bps at 15- 16 December FOMC meeting, with the corresponding probability hovering around 80%. It is believed that the November employment report should help the Fed feel more comfortable about proceeding with the first fed funds rate hike in almost a decade at its meeting next week. Nonfarm payrolls have been increasing by a monthly rate of more than 200k on average in 2015, and the unemployment rate is currently within the Fed's NAIRU range. Hence, the rate-hiking cycle is expected to begin next week, with the normalization process probably being gradual and data dependent so as not to generate an unwarranted tightening in financial conditions.

US November employment report provides further evidence for a December Fed funds rate hike

Monday, December 7, 2015 9:41 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX