D-day is finally here, last FOMC meeting of the year, decision today, in which FED is widely expected to increase rates from zero bound by a hike of 25 basis points, almost a decade after last one. The decision would be announced at 19:00 GMT, followed by a press conference at 19:30 GMT by FED Chair Janet Yellen.

Market is pricing 83% probability that rates will rise in today's meeting as of now.

In this, FED liftoff series, we have been discussing over the impact, implications and various possibilities of a first rate hike from FED in about a decade. Last time FED hiked rates was back in 2006.

In previous articles we discussed why rate hike from FED is still crucial, despite it being well priced in, beginning of a mega unwinding of monetary stimulus, our take on US rates via term premia, impact on equities, various expectations over FED hike path and first and second part on our take on Dollar (D-Dollar and C-Dollar).

In this piece, we take on the E -Dollar.

E- Dollar -

Previously we discussed, Why Dollar needs to segregated to three parts at least and the need for differentiation. We have been calling them,

- Dollar against developed market currencies (D-Dollar)

- Dollar against commodity currencies (C-Dollar)

- Dollar against emerging market currencies (E-Dollar)

Taking note of E-Dollar is essential because not all emerging markets' bonds, equities and currencies are suffering the impact of E-Dollar. For example, Colombia, Peru, Nigeria's sufferings are largely due to C-Dollar, whereas countries like India, Brazil are likely to suffer the consequences of E-Dollar.

Differentiation is not flowery but necessary.

One yield curve but varies pace of rise in credit -

Despite our differentiation in Dollar, it is important to note that there is only one yield curve for the Dollar, however different pace of rise in credit exposure demand the differentiation. Since 2008 financial crisis, and near zero rates in developed world, hunt for yield has led to the flow of Dollar to emerging markets, where corporates grabbed the opportunity to bubble their balance sheet, with debt, both foreign and domestic. Dollar denominated credit expansion has been much faster in emerging market than US.

Here, FED, despite its intention to inflate asset price, miscalculated the expansion of credit and the above was not intended.

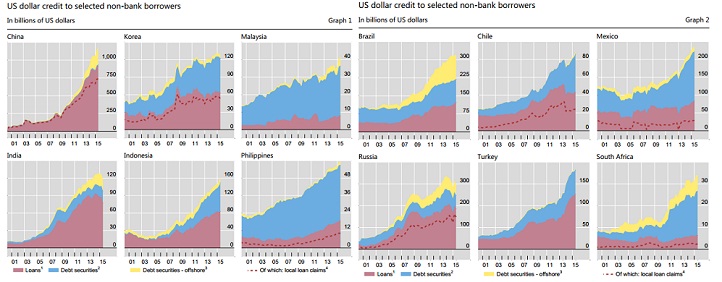

Dollar credit to non-banks outside United States reached $9.8 trillion by second quarter of 2015. Borrowers from emerging markets (both resident and non-resident) accounts for almost $4 trillion. To add to the worry, unviable projects, financed by cheap Dollar credit has also attracted domestic banks to extend local currency debt to the corporates. Companies have also issued more local currency bonds overseas since 2008 crisis.

While 2013, Taper tantrum gave glimpse of the crisis in hand, but it could be far worse this time around and risks of this mega tantrum will rise with each subsequent hikes and policy wind up by other developed market central banks (ECB).

Standing here, as cost of Dollar financing move up, so does the risks of the corporates, which could give rise to financing cost in local currency terms too.

Credit concentration -

Credit concentration is another reason, why differentiation between Dollar against emerging currencies and E-Dollar is needed.

According to Bank of International Settlements (BIS) study, corporates in 12 countries account for 70% of the total US Dollar debt amounting to almost $2.9 trillion, whereas total external debt stands at $3.82 trillion and total debt at $22.5 trillion, more than 100% of their GDP.

According to total US Dollar debt exposure ($ billion) - China (1178), Brazil (322), Russia (297), Mexico (237), Turkey (183), Indonesia (160), South Korea (128), India (118), Chile (88), Philippines (59), Malaysia (41), South Africa (34).

For Mexico, Indonesia, turkey and Russia, Dollar's concentration to total debt is quite alarming and above 30% level.

Spreading vulnerability -

These emerging market economies are very vulnerable to risks spreading from corporate balance sheet to sovereign balance sheet via banking channel and prone to nationwide banking crisis.

Even banks in these economies of high concentration of lending to vulnerable corporates.

E-Dollar can't go home -

Since our E-Dollar got badly stock in these economies, in the quest for yield, we expect going forward dollar cost of financing are going to rise for them.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell