The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. After Friday's super job report market is now pricing 81% probability that FED will hike rates in its December meeting, scheduled for December 15th-16th.

In this, FED liftoff series, we will be discussing over the impact, implications and various possibilities of a first rate hike from FED after more than 9 years. Last time FED hiked rates was back in 2006.

In previous article we discussed why rate hike from FED is still crucial, despite it being well priced in.

In this piece, we address what many economists and analysts (including us) believe that FED hike would signal the beginning of a mega-rewind.

What is mega-rewind?

US Federal Reserve has been one of the earliest central banks, to introduce not only policy easing but to dive beyond conventional interest rate cut. And since then, it has accumulated assets in its balance sheet in the size of $4 trillion, highest ever. Similarly other central banks have followed suit in various degrees.

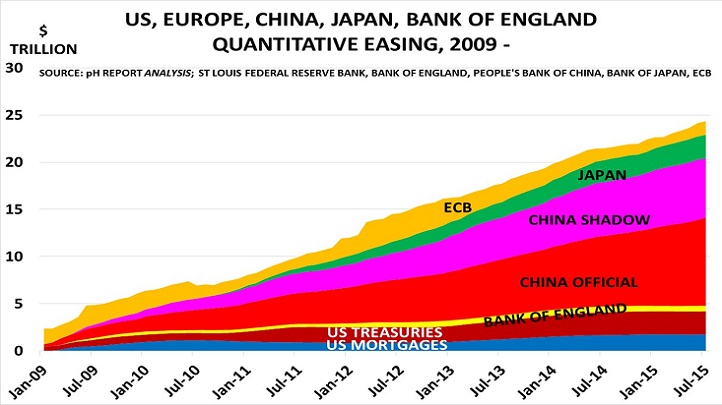

John Richardson, analyst from ICIS, a global chemical, energy and fertilizer industries intelligence provider, point out in this figure that central banks' around the globe has introduced $25 trillion monetary stimulus, The figure could go higher if recent actions by Swedish risk banks, Swiss national banks are taken into account.

World equity markets and rise of bonds have been very closely linked to the rise of stimulus (just check S&P500, Russell2000). So a rate hike from FED is probably a signal that this package is about to expire, if not soon, eventually. European Central Bank (ECB) is now expected to ease at least till March, 2017, however after last meeting ECB is not looking so dovish anymore. Anyone who is not over occupied with central bank movement, will easily be able to see global growth is improving.

Warnings are plenty, if one is looking for. Bank of Japan (BOJ).......though market is expecting further stimulus, it really wants to get out of this uneasy monetary policy.....only problem is Yen would be strong and all the good might reverse....so it is more unlikely that they would increase stimulus. BOJ is already on its way to buy out almost entire JGB market by 2019. Central banker of central banks BIS has called for tighter monetary policies, warning easy monetary policy might be fuelling financial istability.

Time for Panic then?

A close look at the chart would reveal, China almost contributed to half of the stimulus, while FED did only $4 trillion. So no immediate panic, given the smaller balance sheet size of FED.

However, what we pointed out in last article, due to abundance of Dollar (almost $9 trillion loan outstanding outside US), FED is the central banker to the world. So when actual rate rise (rather than speculative rise in yield), lenders will follow suit, swap rates would get adjusted, libor gets a push.

Rush for exit?

With global policy is still on the easing side, there is unlikely to be rush for exit. But there could be wild gyrations in the bond market similar to April/June in European bond market. Volatility is likely to be more frequent and wild. However, it is more likely that FED will be trying to soothe the market with pleasant forward guidance.

Nevertheless it is vital to recognize, the approaching mega-rewind of ultra-easy monetary policy, and most wished inflation could just fasten it.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX