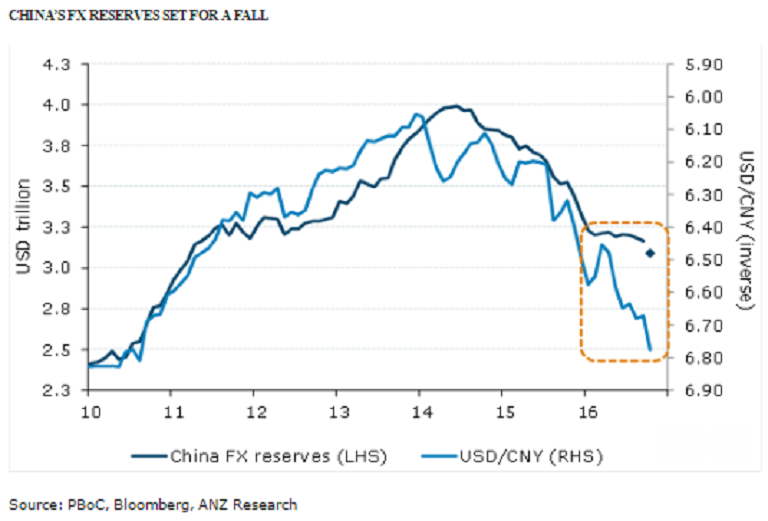

The foreign exchange reserves of China are expected to have sharply fallen during the month of October, following rising intervention from the People’s Bank of China (PBoC) amid strong appreciation of the greenback against its major trading partners and capital loss on fixed income investments.

China’s FX reserves data for October is due for release on 7 November. Despite the weakening in the yuan against the dollar since April, China’s FX reserves have remained fairly stable, with only modest declines recorded in August and September. A further resumption of dollar strength, coupled with the upcoming U.S. presidential election will add to the decline in FX reserves in the world’s second-largest economy.

The PBoC has increased their intervention activity in the past few months, as the market’s demand for dollars increased. It is estimated that during periods when the CNY is under weakening pressure, the PBoC’s FX activity as a share of the total spot trading volumes will rise to around 10 percent or more.

The USD was strong in October, appreciating against most other major currencies. This means that FX valuation effects will be negative in the month. Assuming their allocation is similar to the global aggregate based on the IMF’s COFER data, it is estimated that currency valuation effects will reduce their reserves by around USD30 billion, ANZ reported.

During October, fixed income markets sold off across the board, so mark-to-market losses on their portfolio will reduce the value of China’s FX reserves. Looking at just China’s US Treasury holdings alone, the report estimates that mark-to-market losses would be around USD15 billion.

"For October, we see all key elements acting to reduce China’s headline FX reserves by the most since January, and certainly a lot more than the USD19.1bn decline that the market is anticipating," ANZ commented in its latest research report.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals