CAD/JPY gained slightly after the BOC monetary policy. It hits an low of 111.72 and is currently trading around 113.22.

The Bank of Canada kept its policy rate at 2¼% on January 28, 2026, considering it right given modest near-term growth predicted at 1.1% for 2026 brought on by slowing population and US protectionism changes supported consumer spending, corporate investment, and fiscal policy. Rising to 2.4% in December from base effects, CPI inflation dropped to ~2.5%, expected to remain near the 2% target as excessive supply offsets trade expenses; Ready to react if the outlook changes, the Governing Council emphasizes dual mandate in the face of increased volatility from CUSMA review and worldwide disturbance.

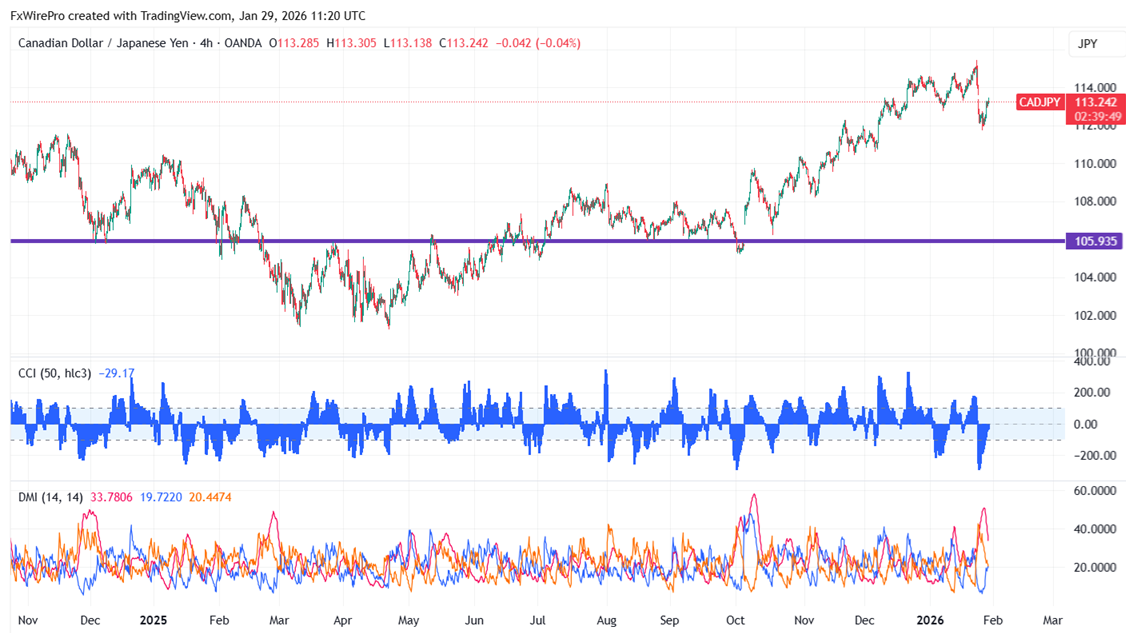

Technical Analysis

CAD/JPY is currently trading above the 34- and 55-EMA and below 200 EMA and 365 EMA on the 4-hour chart. The immediate resistance is at 113.67; a breach above that level could shift targets to 114/115/116/116.91. On the lower side, near-term support is at 112.60,and a break below this support could lead to declines toward 112/111.69/ 111/110.50/110/109.50/109.

Indicator Trends

CCI (50)- Bearish

ADX (14)- Neutral

Trading Strategy Recommendation

It is good to buy on dips around 113 with a stop-loss at 112 for a target price of 115.