Australia’s investor lending rose during the month of August as the effects of June/July rate cuts and APRA changes have continued to flow through to housing finance, according to the latest report from ANZ Research.

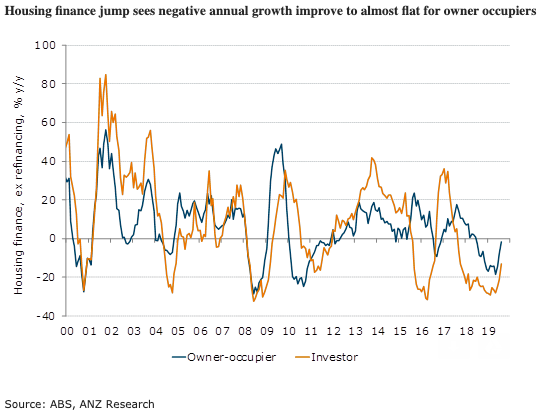

Investor lending was up 5.7 percent m/m in August ex-refinancing, the second-strongest monthly result since May 2015 and a continuation of investor demand after a 4.7 percent m/m result in July 2019. Annual growth in investor lending is still sharply negative (-13.0 percent y/y to July), however this is the smallest negative result in almost two years.

Owner-occupier lending grew 1.9 percent m/m in August ex refinancing. Annual growth is still slightly negative (-1.7 percent y/y), but it is the smallest negative result since June 2018, when y/y owner-occupier demand growth was still positive.

Regulatory easing in July (APRA relaxed the 7 percent + floors on mortgage serviceability) has heightened the effects of rate cuts, by allowing lower rates to more directly affect serviceability assessments, the report added.

"Optimism in the housing market following a sharp uptick in Sydney and Melbourne prices may have also spurred on extra demand from investors," ANZ further commented in the report.

South Korea Industry Minister Heads to Washington Amid U.S. Tariff Hike Concerns

South Korea Industry Minister Heads to Washington Amid U.S. Tariff Hike Concerns  U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal

U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal  Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support

Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support  Indonesian Stocks Plunge as MSCI Downgrade Risk Sparks Investor Exodus

Indonesian Stocks Plunge as MSCI Downgrade Risk Sparks Investor Exodus  Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout

Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout  China Home Prices Rise in January as Government Signals Stronger Support for Property Market

China Home Prices Rise in January as Government Signals Stronger Support for Property Market  Asian Currencies Trade Flat as Dollar Retreats After Fed Decision

Asian Currencies Trade Flat as Dollar Retreats After Fed Decision  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns

Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns  Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions

Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions