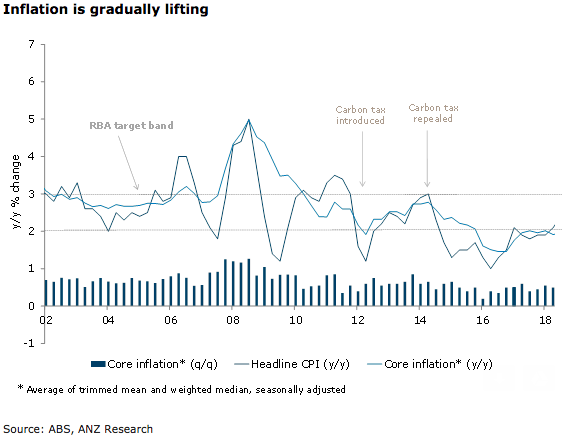

Australia’s consumer price inflation for the second quarter of this year slightly beat market expectations, confirming that inflationary pressures are building only very gradually. From a policy perspective, the Q2 data supports the case that the Reserve Bank of Australia (RBA) is a long way from policy tightening.

Headline CPI rose 0.4 percent q/q, a little below expectations of 0.5 percent q/q. This was still sufficient to push annual inflation higher, to 2.1 percent y/y from 1.9 percent y/y in the first quarter. As expected, petrol prices contributed 0.2 ppt of the rise.

Both the trimmed mean and weighted median rose by 0.5 percent q/q, in line with expectations, leaving annual core inflation running a touch below the central bank’s target band. Looking in more detail, the average of the two measures rose 0.46% q/q, a step-down from 0.54% in Q1. CPI ex volatiles (seasonally adjusted) rose 0.47 percent q/q. In annual terms, core inflation decelerated a touch, to 1.9 percent y/y, from (an upwardly revised) 2.0 percent y/y in Q1.

Further, tradable prices were boosted by the 6.9 percent rise in petrol prices in Q1, excluding volatiles and tobacco tradable prices, seasonally adjusted, fell by 0.5 percent q/q, down 2.6 percent y/y. Retail competition is still impacting, with prices lower over the year for clothing & footwear (-2.0 percent), furniture & furnishings (-2.1 percent) and household appliances (-1.6 percent).

"In our view, inflation will rise only very gradually, with sufficient progress toward the mid-point of the policy target band unlikely to emerge until H2 2019. Higher inflation will require a lift in wage growth feeding through to domestic services prices. Focus will now turn to the Q2 Wage price Index on August 15," ANZ Research commented in its latest report.

Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes

Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations

India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations  South Korea Exports Surge in January on AI Chip Demand, Marking Fastest Growth in 4.5 Years

South Korea Exports Surge in January on AI Chip Demand, Marking Fastest Growth in 4.5 Years  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data

U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data  Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair

Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair