Dec 09, 2015 07:28 am UTC| Technicals

Technical glance: On weekly charts, we are tracing out sufficient bearish calls, The prevailing prices of this APAC pair falls well below 21DMA that signifies the long term downtrend to prolong, while leading...

Major European Indices Technical Update

Dec 09, 2015 07:05 am UTC| Technicals

Germany DAX Index: Germany DAX index has made a low of 10612 (trend line joining 9301 and 9392 and 55 day W EMA) and slightly recovered from that level. It has closed around 10680. Major support is around...

Dec 09, 2015 07:03 am UTC| Technicals

For now, we could foresee more downside potential for this APAC pair, this could still drag downwards up to 1.0856 levels which is 38.2% fibo retracements from the peaks of 1.1087. The prevailing prices of this APAC...

FxWirePro: BTC/USD trades well above $400, good to buy at dips

Dec 09, 2015 06:29 am UTC| Technicals Digital Currency

BTC/USD has broken major resistance $400 and jumped till $422.28. Short term trend is still bullish long as major support $380 holds. On the higher side major resistance is around $424 (61.8% retracement of $502 and...

Watchout for AUD/USD break below 0.72 for further downside

Dec 09, 2015 05:41 am UTC| Technicals

Selloff in oil and bulk commodities which extended for a third day weighed heavily on currencies of major commodity producers such as Australia. AUD/USD rejected at days high by 0.7237, back to opening level at...

EURUSD breaks minor resistance 1.09050, targets 1.09800

Dec 09, 2015 05:32 am UTC| Technicals

Intraday Trend -Bullish The pair has made a low of 1.08301 yesterday and recovered from that level. It is currently trading around 1.09128. Major resistance -1.0905 (55 day EMA) EUR/USD has broken 1.09050...

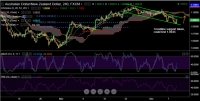

FxWirePro: Kiwi weak heading into RBNZ tomorrow, good to buy AUD/NZD dips

Dec 09, 2015 04:28 am UTC| Technicals

AUD/NZD slightly bid in the Asian session up around 0.25% as we head into the RBNZ policy meet tomorrow. RBNZ is widely expected to cut rates at tomorrows meeting by 25bps, to 2.50 percent. In the event it does cut...

- Market Data