EURJPY Loses Luster – Yen Power Sends Pair Plunging to 175 Target

Nov 04, 2025 12:51 pm UTC| Technicals

EURJPYlost its shine on the strong yen. Intraday remains bearish as long as the resistance at 177.25 holds. Technical Analysis: The EUR/JPY pair is tradingbelow above 55 EMA, 200, and 365-H EMA on the 1-hour...

EUR/USD in Freefall: Triple EMA Smash Confirms 1.1400 Dive

Nov 04, 2025 12:45 pm UTC| Technicals

EUR/USDlost its shine and hit a 3-month low on US dollar strength. It hits an intraday low of 1.14809 and is currently trading around 1.14809.Intraday trend remains bearish as long as resistance 1.1540 holds. The pair...

Hayes + Naval = ZEC Moon: $137M Grayscale Inflow, $10K Prophecy

Nov 04, 2025 12:43 pm UTC| Digital Currency Technicals

Arthur Hayes starts a 971 percent rally with a semi-quantum Zcash wager, bringing ZEC to $10K. Predicting a $10,000 price tag and describing it as Bitcoins privacy rival, Arthur Hayes has supercharged Zcash (ZEC) and...

FxWirePro: GBP/USD falls towards 1.3000 as UK fiscal worries deepen

Nov 04, 2025 12:17 pm UTC| Technicals

GBP/USD declined on Tuesday after finance minister Rachel Reeves reiterated her commitment to sticking to her fiscal rules in her November budget. In an unusual pre-budget appearance, Reeves outlined her budget as one...

GBPJPY Struggles Below 203: Sell on Rallies for a Target of 200

Nov 04, 2025 08:10 am UTC| Technicals

GBPJPY pared most of its gains as the yen gained momentum.Intraday trend is bearish as long as the resistance at 203 holds. It hits an intraday low of 201.45 and is currently trading around 201.48. Oscillatorsand moving...

FxWirePro: USD/CNY hits two-week high as dollar strengthens broadly

Nov 04, 2025 05:58 am UTC| Technicals

USD/CNY hit two-week high on Tuesday as yuan was pressured by broad greenback strength in global markets as traders reduced bets on Federal Reserve interest rate cuts. The U.S. dollar hovered near a three-month high...

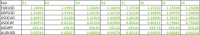

- Market Data