NZD/JPY: Key Support Holds Amid Mixed Signals – Buy on Dips for a Rally to 89.20

Nov 19, 2025 05:16 am UTC| Technicals

NZDJPY declined sharply after a minor pullback above 88 on a weak New Zealand dollar.The intraday trend is bullish as long as support 87.20holds. Having dipped to an intraday low of 87.41, it now trades at about...

FxWirePro: USD/ JPY bulls struggles as upside momentum fades

Nov 19, 2025 03:52 am UTC| Technicals

USD/JPY eased slightly on Wednesday as investors assessed the central banks tightening amid Japans expansionary fiscal outlook under Takaichi. BOJ Governor Ueda told PM Takaichi that the central bank is gradually...

FxWirePro: EUR/AUD retreats slightly but trend is still bullish

Nov 18, 2025 23:41 pm UTC| Technicals

EUR/AUD dipped on Tuesday as a broad risk-off mood gripped global markets. Investor sentiment globally has been fragile, traders are also cautious ahead of the long-delayed U.S. jobs report due on Thursday. The...

FxWirePro: GBP/AUD dips ahead of key UK CPI report

Nov 18, 2025 23:25 pm UTC| Technicals

GBP/AUD dipped on Tuesday but downside was limited as focus now turned to Wednesdays UK CPI report. Headline CPI is forecast to ease to 3.6% YoY from 3.8%, while core inflation is expected to dip to 3.4% from...

FxWirePro: GBP/NZD little changed as markets brace for UK CPI report

Nov 18, 2025 23:07 pm UTC| Technicals

GBP/NZD was little changed on Tuesday as investors awaited British inflation data on Wednesday which could provide additional clues about the Bank of England policy path. Lower-than-forecast inflation would reinforce...

FxWirePro: USD/CAD slips as loonie strengthens after carney’s budget wins confidence vote

Nov 18, 2025 17:48 pm UTC| Technicals

USD/CAD dipped on Tuesday as the Canadian dollar firmed after Mark Carneys budget passed a confidence vote in Ottawa. Prime Minister Mark Carney survived his first major hurdle on Monday, with Parliament narrowly...

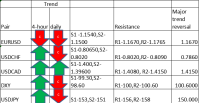

FxWirePro- Major Pair levels and bias summary

Nov 18, 2025 17:35 pm UTC| Technicals

Major Pair levels and bias...

- Market Data