USDCHF PPI-Powered Spike Fades: Sell Rallies Near 0.7750 – Eyes 0.7500 Drop

Jan 30, 2026 17:39 pm UTC| Technicals

USDCHF showed a nice jump after hot US PPI data. Having made ahigh of 0.77270yesterday, it iscurrentlytrading at 0.76822. With headline PPI growing 0.5% m/m (against a predicted +0.2% and prior +0.2%), US PPI for...

CAD/JPY Dips After Weak GDP – Buy the Pullback at 113, Eyes 115 Breakout

Jan 30, 2026 17:19 pm UTC| Technicals

CAD/JPYpared most of its gains after weak Canadian GDP data. It hits anintraday high of 114.45 and is currently trading around 113.81. Flat at 0.0%, Canadas monthly GDP m/m for November 2025 corroborated preliminary...

FxWirePro: USD/CAD claws back some ground, but downtrend remains intact

Jan 30, 2026 17:00 pm UTC| Technicals

USD/CAD rebounded on Friday as Canadian dollar weakened after Canadas GDP growth stalled in November. Canadas economic growth stalled in November as an expansion in services was offset by weakness in goods-producing...

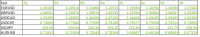

FxWirePro- Major European Indices

Jan 30, 2026 10:51 am UTC| Technicals

Germany DAX - 24459 (-0.13%) Major resistance- 25600 Near-term resistance - 25000/25200/25442 Minor support - 24480//24200/23900/23600/23400/22900. Trend reversal level- 17000 The pair holds...

GBPJPY Bulls Stay in Charge: Holding 210 Unlocks 214+ Upside – Buy the Dip

Jan 30, 2026 10:41 am UTC| Technicals

GBPJPY trades flat with positive bias.The intraday trend is bullish as long as support 210holds.As of publishing, it is trading around 211.93; its intraday high is 212. Oscillatorsand moving averagestoforecastthe trend...

Oil Spikes on US-Iran Fire: $66 Highs Hit, Buy the Dip at $57–58 for $63 Bounce

Jan 30, 2026 10:29 am UTC| Technicals

Prices for crude oil surged on the escalation of tension between the US and Iran.It is presently trading around $64.52after reaching a high of $66.48. As US-Iran relations heightened in late January 2026, crude oil...

- Market Data