FxWirePro: Bid 1m/2m GBP/USD OTC indications and deploy diagonal options straps on hedging grounds

Mar 20, 2018 07:08 am UTC| Research & Analysis Insights & Views

A glance at underlying spot FX: Weve already stated in our technical section that the Cable is surging up quite well. Thiss just a reiteration that the demand zone is slightly lower in the near-term around 1.3880 levels,...

FxWirePro: No traces of recovery for Turkish lira - Try OTC calls to hedge TRY FX risks

Mar 19, 2018 13:11 pm UTC| Research & Analysis Insights & Views

The lira is depreciating steadily once again, and reached a point last week where we should start watching developments closely - after this point, currency weakness will begin to reflect in inflation prints down the road,...

Mar 19, 2018 12:10 pm UTC| Research & Analysis Insights & Views

Crude prices today seems to be edgy on demand/supply equation. WTI CFDs are trading between the tight range of $62.26 and $61.97 levels as lingering concerns over output and eclipsed demand projections coupled with other...

FxWirePro: What-if scenario and OTC analysis and reverse collar strategy to optimize EUR/USD hedging

Mar 19, 2018 10:35 am UTC| Research & Analysis Central Banks

What-if below driving forces materialize? a scenario analysis: 1) Eventual repatriation by US corporates-EUR accounts for a third of foreign profits. 2) EUR appreciation delays ECB policy normalization (change in QE...

Mar 19, 2018 09:30 am UTC| Research & Analysis Insights & Views

Last week, the trade protectionism theme shot back into focus as a potential major left tail risk for markets which got further aggravated by the subsequent retaliatory rhetoric from Europe and Asia. President Trump has...

FxWirePro: AUD/USD medium term perspectives and a run through on put ratio back spreads

Mar 19, 2018 07:26 am UTC| Research & Analysis Insights & Views Central Banks

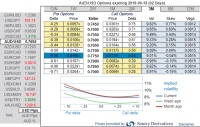

AUDUSD near-term momentum appears to be negative, targeting the 0.7650-0.7700 area if the USD rebound persists. While the medium-term perspective remains slightly pricey compared to short-term fair value projections, as...

FxWirePro: Spotlight on EMFX space and trade baskets ahead of FOMC

Mar 16, 2018 12:10 pm UTC| Research & Analysis Central Banks Insights & Views

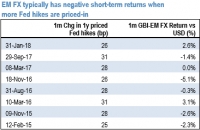

The short-term repricing of Fed hikes is typically not supportive of EM FX returns, which also motivates our selective hedges (e.g. TRY and MXN). The recent research in the past emphasized the distinction between increases...

Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows

- Market Data