A glance at underlying spot FX: We’ve already stated in our technical section that the Cable is surging up quite well. This’s just a reiteration that the demand zone is slightly lower in the near-term around 1.3880 levels, while the stiff resistance remains around 1.4000 regions. Momentum studies remain flat but slightly in bulls favor, providing little guidance. While over 1.3880, the risks are greater for a test through 1.40, opening a shift towards more important resistance in the 1.41-1.42 region. A decline through 1.3880 would risk a deeper setback to re-test 1.3825-1.3712 previous lows. Medium-term we remain in a correction after peaking around 1.4350, which still has the potential overall for a move back to the 1.3650-1.3450 region.

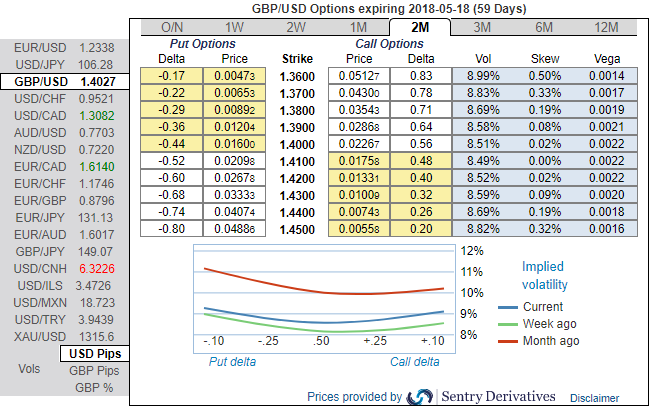

Well, this projection is evident in GBP OTC hedging sentiments. Let’s glance on GBPUSD sensitivity tool, the positive shift in risks reversals (refer 1m RRs) that indicates the bullish risks in underlying spot FX prices in near-terms which is in tandem with the technical analysis but bearish sentiments are mounting in medium-term basis (3m tenors).

While positively skewed IVs of 2m tenors are well balanced that signifies the hedging interests in both bearish and bullish risks, as a result, OTM puts/call strikes likely to expiring in-the-money.

But bearish risks in longer tenors remain intact as the negative risk reversals of longer tenors indicate hedgers still bid for downside risks. ATM IVs are trending between 8.4% - 8.5% ranges for 1-2M tenors.

Hence, in order to arrest both upside risk that is lingering in short-term trend and major declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in short run and mitigates bearish risks in the medium term.

So, we advocate building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 3m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bullish as well as bearish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether underlying spot keeps flying or dipping.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 150 levels (which is highly bullish). Hourly USD spot index was at shy above -15 (mildly bearish) while articulating (at 07:06 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data