Last week, the trade protectionism theme shot back into focus as a potential major left tail risk for markets which got further aggravated by the subsequent retaliatory rhetoric from Europe and Asia. President Trump has followed through on his promise to impose tariffs on steel and aluminum imports.

They also tend to be growth negative for emerging markets that thrive on global trade, especially if retaliatory tariffs are involved. Despite these risks, high beta currencies have so far shown impressive resilience as investors have been reluctant to turn overly bearish given above-trend global growth. The lack of many reactions from the likes of AUD, NZD, and CAD opens up opportunities to buy underpriced option hedges.

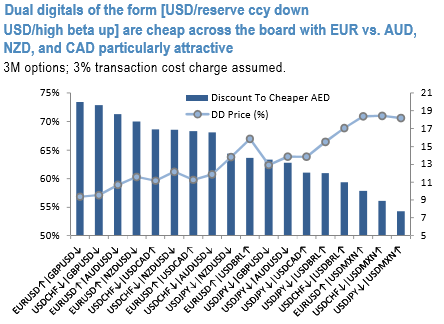

Short high vs low beta USD correlations via dual digitals and worst-of options: To directly take advantage of elevated implied USD correlations from 3rd chart while hedging against a potential escalation of trade clashes, one could opt out for de-coupling views expressed via dual digitals.

Admittedly, it is difficult to anticipate the exact global dynamics that may play out (with EM Asia possibly getting stuck in a limbo between deteriorating global conditions and central banks interventions), so the analysis focuses on G10 FX and the most directly impacted EM (MXN and BRL).

Among reserve currencies, JPY, EUR, and CHF are of interest as primary safe haven currencies while GBP is bucketed with high beta G10 amid ongoing political vulnerability in the UK and with Britain being one of the trade partners directly impacted by the steel and aluminum tariffs. Bullish JPY was well subscribed-to even before the February equity shock and both spot and vol there have run up a fair bit, hence, better value in fresh de-correlation plays is to be found in EUR-crosses.

Dual digitals of the form (USD/reserve FX down, USD/high beta up) pricing (refer 1st chart) is particularly attractive in EUR vs. AUD and EUR vs. NZD at >8x gearing on 3M 1% OTMS options (after 3% b/o charge). 1% OTMS strikes, set on both legs, should be a modest hurdle to overcome in case of adverse trade developments, but even setting a high beta strike at ATMS to give more room to the so far resilient high beta FX would only lift nominal option prices into the to mid-teens.

3M EURUSD > 1% OTMS, AUDUSD < 1.0% OTMS, dual digital costs 10.6%.

3M EURUSD > 1% OTMS, NZDUSD < 1.0% OTMS, dual digital costs 10.7%.

Alternatively, to take advantage of a similar vol/ correlation setup, one could play directionally stronger reserve currency vs. weaker high beta (vs. the USD) via worst-of options. Rich correlations and still generally depressed vols (especially in EUR crosses) map into the favorable pricing of worst-of options for EURUSD vs. AUDUSD that are priced near the multi-year lows in premium (refer 2nd chart). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics