2017’s rally in the U.S. stocks is continuing well into 2018. However, some signs are emerging which suggests that stocks are becoming overvalued and a correction looks increasingly likely. In 2017, the U.S. benchmark stock index returned more than 19 percent and in 2018, they have returned 2.9 percent so far, which is quite remarkable. While the latest increase is being supported by the recent changes in the U.S. tax code, one indicator is strongly suggesting stock overvaluation despite the tax euphoria.

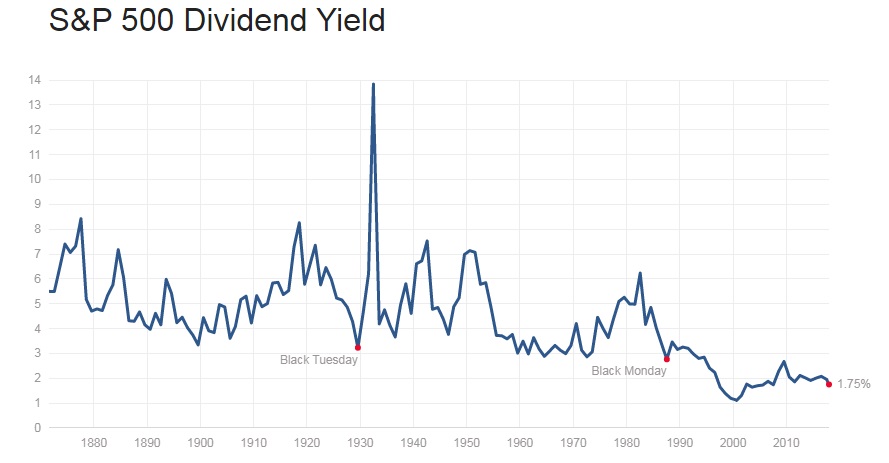

The above chart shows the historical S&P500 dividend yield. As of latest data, it has declined to 1.75 percent, the lowest level in more than a decade, while the recent rate hikes by the U.S. Federal Reserve has pushed the short-term rate (both1-year and 2-year) above the dividend yield. The dividend yield is widely used to calculate the future return from stocks.

As of today, the U.S. 1-year treasury is returning about 1.78 percent, while the 2-year treasury is returning about 1.97 percent. A further spike in yields and rate hikes could bring about a major correction in the stocks.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks