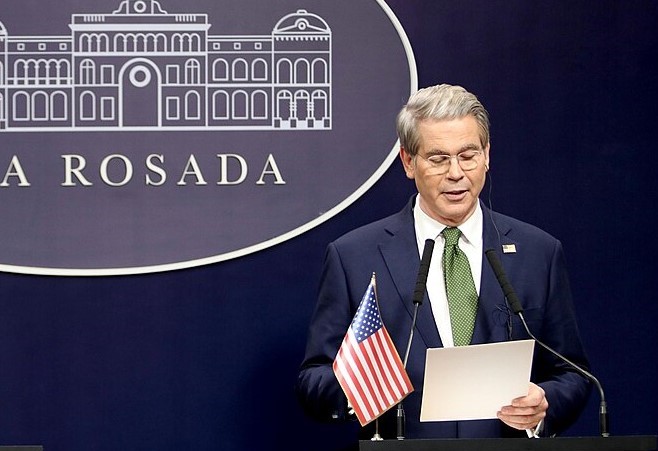

Treasury Secretary Scott Bessent said he expects the Federal Reserve to cut interest rates by September, arguing that President Donald Trump’s trade tariffs are not fueling inflation as feared. In an interview on Fox News’ Ingraham Angle, Bessent criticized the Fed’s hesitation to ease policy despite lowering its growth outlook.

“It’s bewildering to me that the Fed hasn’t already cut rates,” Bessent said. “If they believe tariffs aren’t inflationary, they could move sooner—but certainly by September.”

His remarks follow a similar forecast from Goldman Sachs, which expects the first rate cut in September, with two more by year-end. The Fed, however, remains cautious. Chair Jerome Powell reiterated in Portugal that uncertainty over inflation, driven in part by Trump’s tariffs, remains a key concern.

Data from the PCE price index, the Fed’s preferred inflation measure, showed inflation in May remained above the 2% target, complicating the case for monetary easing. Still, Bessent emphasized that tariffs should not be seen as inflationary and suggested that the central bank’s own criteria support a rate cut soon.

President Trump has publicly pressured Powell to lower rates and is reportedly considering naming a successor early, potentially to undercut Powell’s leadership.

Addressing other issues, Bessent dismissed Tesla CEO Elon Musk’s criticism of Trump’s economic policies, saying, “If Elon sticks to rockets, I’ll stick to finance.” He also expressed confidence that Trump’s proposed bill will reduce the national debt over time, despite growing fiscal concerns.

Bessent’s comments add to the growing debate over the Fed’s policy direction as inflation, interest rates, and trade tensions remain at the forefront of economic discussions.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges