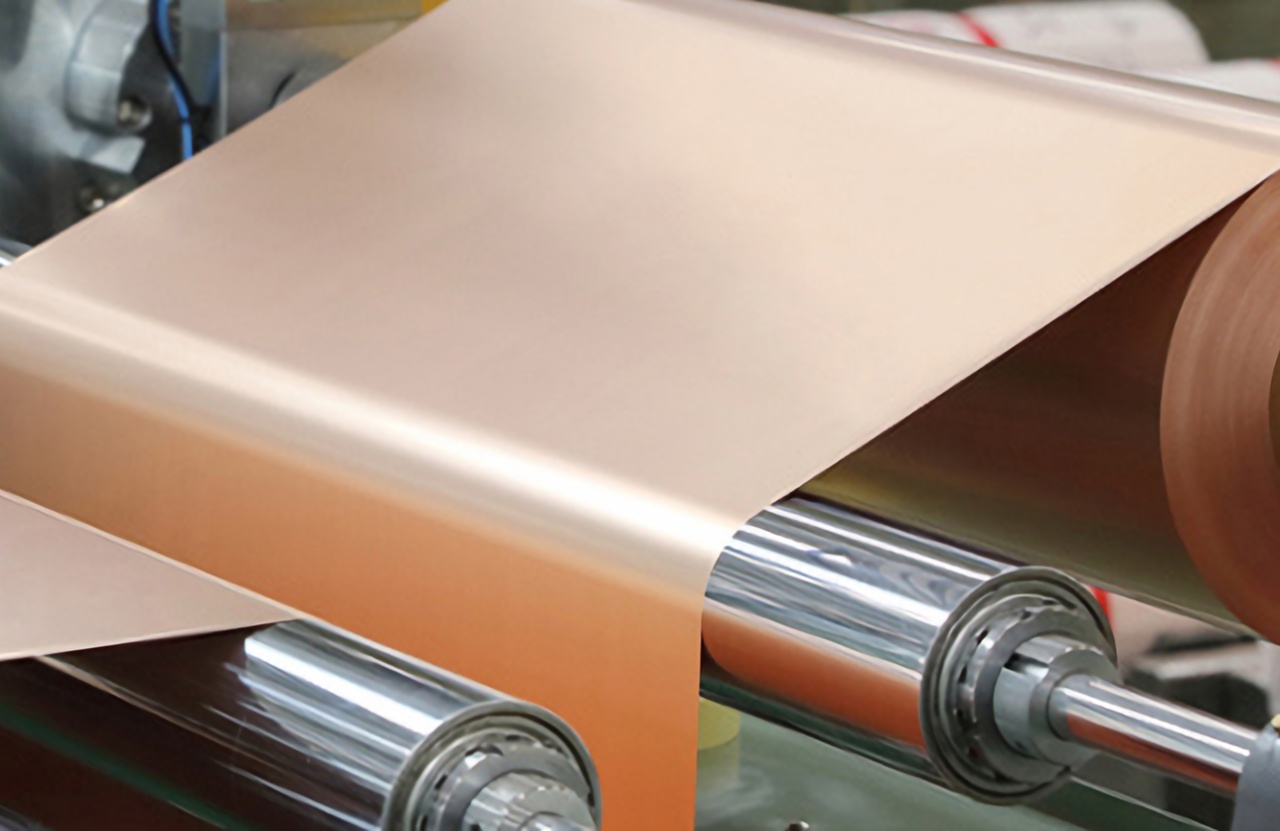

Lotte Energy Materials Corp., that has been formerly known as Iljin Materials, is set to construct its new production plant in the United States. The leading copper foil producer in South Korea has already filed an application for the construction.

Once it secured the required permissions from the U.S. state government of Delaware, Lotte Energy Materials will proceed with the groundbreaking, which it hopes can take place some time next year. The company is building this facility to meet Tesla’s increasing demand for battery components. It is also aiming to supply its products to other electric vehicle makers in North America.

At any rate, The Korea Economic Daily reported that it usually takes two weeks for building applications to be reviewed, and the company is looking forward to getting permission soon.

Lotte Energy Materials has not yet decided on the exact location for its factory, but it is looking into Tennessee, Michigan, and Kentucky, as these are the regions where most of the American and South Korean automakers operate.

While it is securing the permit to build, the firm is also in talks with some state governments in the country for potential tax benefits for the construction. Lotte is expected to finalize the site location by the end of this year. The estimated initial investments for this project are between KRW700 billion and KRW800 billion, or about $526 million to $601 million.

“The North American electric vehicle market has entered a full-fledged growth trajectory, and investments from Korean battery manufacturers who expect to benefit from IRA are continuing to pour in,” Hankyung quoted an official in the battery industry as saying in a statement. “The construction of Lotte Energy Materials’ U.S. factory will expand its market dominance in the North American market.” “It is an essential measure to take.”

Photo by: Lotte Energy Materials PR Center

Climate Adaptation at Home: How Irrigreen Makes Conservation Effortless

Climate Adaptation at Home: How Irrigreen Makes Conservation Effortless  Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets

Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets  China Home Prices Rise in January as Government Signals Stronger Support for Property Market

China Home Prices Rise in January as Government Signals Stronger Support for Property Market  Elon Musk’s SpaceX Explores Merger Options With Tesla or xAI, Reports Say

Elon Musk’s SpaceX Explores Merger Options With Tesla or xAI, Reports Say  Using the Economic Calendar to Reduce Surprise Driven Losses in Forex

Using the Economic Calendar to Reduce Surprise Driven Losses in Forex  Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.

Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal

U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal  India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures

India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures  CSPC Pharma and AstraZeneca Forge Multibillion-Dollar Partnership to Develop Long-Acting Peptide Drugs

CSPC Pharma and AstraZeneca Forge Multibillion-Dollar Partnership to Develop Long-Acting Peptide Drugs  Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify

Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify  Apple Forecasts Strong Revenue Growth as iPhone Demand Surges in China and India

Apple Forecasts Strong Revenue Growth as iPhone Demand Surges in China and India  Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions  U.S. Dollar Slides for Second Week as Tariff Threats and Iran Tensions Shake Markets

U.S. Dollar Slides for Second Week as Tariff Threats and Iran Tensions Shake Markets  Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute

Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute  Trump Threatens Aircraft Tariffs as U.S.-Canada Jet Certification Dispute Escalates

Trump Threatens Aircraft Tariffs as U.S.-Canada Jet Certification Dispute Escalates  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons