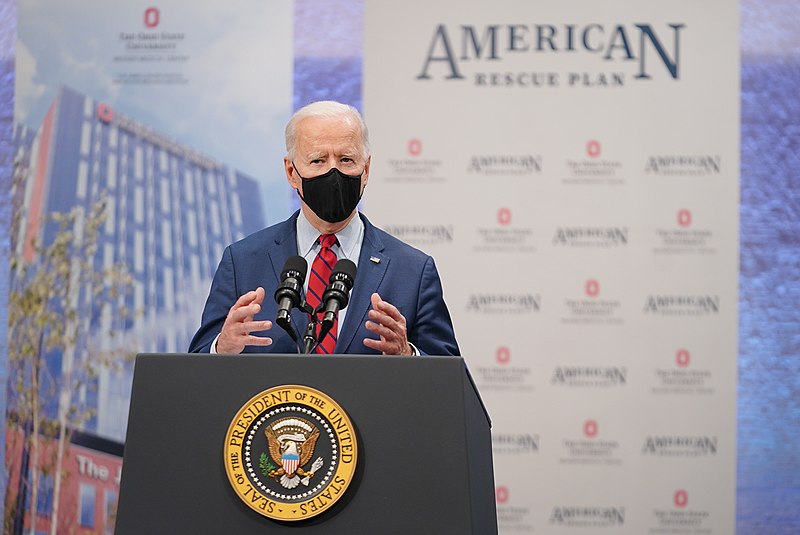

With the passage of the $1.9 trillion COVID relief proposal, the plan aims to cut child poverty in half. President Joe Biden announced that the child tax credit payments to families will begin by July.

The White House released a short statement from Biden regarding the provision of the plan, which looks to cut child poverty in half. Biden also urged Congress to pass his American Families Plan that will see the expansion of the child tax credit. Biden’s statement comes after the announcement made by the US Treasury, that Americans with children may begin to receive their child tax credit payments starting July 15.

“With today’s announcement, about 90% of families with children will get this new tax relief automatically, starting in July. While the American Rescue Plan provides for this vital tax relief to hard-working families for this year, Congress must pass the American Families Plan to ensure that working families will be able to count on this relief for years to come,” said Biden in the statement.

Almost 88 percent of children are going to receive the benefits without the need for their parents to take any additional action. Qualified families will be able to receive up to $300 a month for each child under six years old and $250 for children between six to 17 years old. The child tax credit was previously capped at $2000 and was originally only paid out to families that have income tax obligations.

However, for 2021, couples that earn less than $150,000 can receive the full payments every 15th of the month, mostly in direct deposits. Annually, the benefits for children under six years old amount to $3600 and for children between 6 to 17 years old, $3000.

In other news, Biden has continued with the tradition of presidents publicizing their financial records. Biden and first lady Dr. Jill Biden released their tax returns for 2020, the couple making over $600,000 and paid $157,414 of income tax. This amounts to a 25.6 percent federal income tax rate for the Bidens.

The Bidens also paid $28,794 in income taxes to their home state of Delaware. They were also reported to having donated $30,704 to 10 different charities.

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages