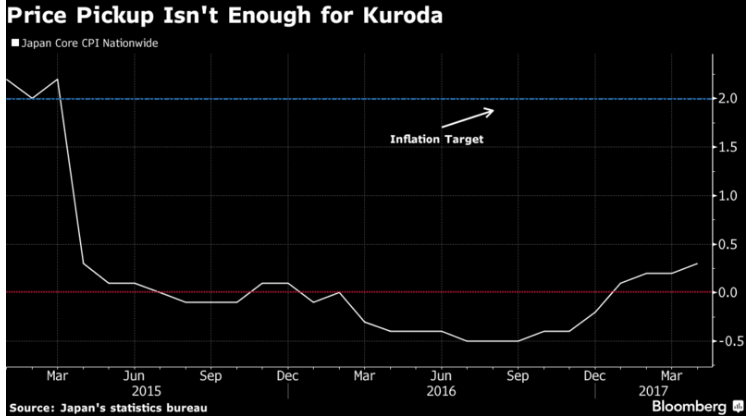

In Japan, data from the Internal Affairs Ministry showed on Friday that Japan’s core consumer inflation gauge rose for a fourth month in April, the longest run of gains since mid-2015, but remains far below the central bank's target. Both headline and core CPI inflation for April increased to 0.4 percent y/y and 0.3 percent y/y, respectively, but they remain well below the Bank of Japan’s (BoJ) target of 2.0 percent.

The Bank of Japan's preferred measure of core CPI (excluding fresh foods and energy) and its forecast measure of core CPI (excluding fresh foods) rose 0.1ppt to 0.0 percent Y/Y and 0.3 percent Y/Y respectively. The ‘core’ core rate, the measure consistent with core measures used in the other major economies, was still firmly in negative territory, unchanged on the month at 0.3 percent Y/Y, the lowest rate for almost four years just after the launch of QQE.

"We expect inflation to maintain a gradual upward trend over coming months associated with base effects of energy costs, with core CPI likely to rise close to 1%Y/Y by around September. But given the persistent weakness of underlying inflation, and not least due to the behaviour of wages which will likely serve to both limit cost pressures and restrain demand, we think that inflation will likely struggle to shift significantly higher than that," said Daiwa Capital Markets in a report.

Bank of Japan Governor Haruhiko Kuroda is pinning his hopes on rising energy costs, wage gains and the BOJ’s monetary stimulus program. Since wage growth remains weak, cost pressures are not strong enough to sustain stronger inflation. Former Federal Reserve Chairman Ben Bernanke said in Tokyo this week that the BOJ’s policy options are becoming scarce and more explicit cooperation with the government would be appropriate if inflation remains weak.

"Having committed to expanding the balance sheet until core CPI exceeds the 2% target in a stable manner, the Policy Board’s ultra-accommodative policy stance seems set to remain in place for a long time to come," adds Daiwa Capital Markets.

Meanwhile, Japan’s Nikkei 225 closed 0.64 percent lower on Friday at 19,686.84 points. At 1145 GMT, USD/JPY was trading at 111.00, down 0.74 percent on the day. At the same time, FxWirePro's Hourly Yen Strength Index remained highly bullish at 110 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand