The brisk spike in inflation probably rules out new cuts by the central bank in Sweden. After four years mainly spent below 1%, the Swedish CPIF bounced sharply to 1.5% at the beginning of the year, taking a step towards the 2% inflation target. The Riksbank made clear that policy needs to continue to be expansionary to safeguard the rising trend in prices to prevent an excessively fast SEK appreciation.

But with the main rate already at -50bp (at only a step from the implicit floor set in Switzerland at -75bp) and inflation expected to stabilise around 2% next year, new cuts are probably ruled out by the board.

Relative economic factors surprise to pressure EURSEK. With its 4.2% y/y Q1 GDP growth largely beating the European average, Sweden does not have serious competitors among developed countries.

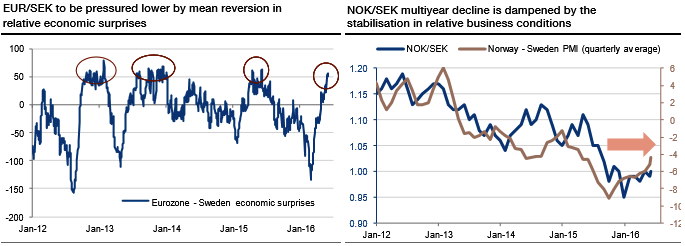

However, the FX market has to deal with a set of negative economic surprises in Sweden whereas the euro area benefited from a positive trend.

It turns out the surprise differential is just reaching its historical peak above 50 points (see graph), with past patterns suggesting a mean reversion lower sooner or later. This should be a key factor pressuring the EURSEK towards 9.5 levels again.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary