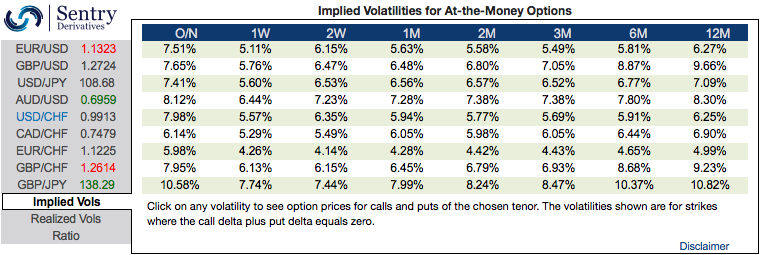

This has been a year of lower vols, especially among FX space. Just glance at the OTC FX markets, shrinking implied volatilities (IVs) are luring options writers. Please observe USDCHF and EURCHF are showing lower IVs despite the schedule of SNB’s monetary policy event for this week.

That is because the Swiss National Bank (SNB) has been maintaining the status quo in its monetary policy to leave everything unchanged (kept libor rate at -0.75%). Consequently, the development of CHF over the past weeks did not seem to have provided any reason to tighten the monetary policy reins after all. With lingering uncertainty over the Italian budget conflict and Brexit, CHF seems to be much more in demand again recently. During such a circumstance that the SNB does not want to give the FX market any other arguments for trading the franc at stronger levels, which would put pressure on the inflation outlook and domestic exports.

The medium-term fundamental factors which support CHF are still intact in our opinion, even if they comprise relatively slow-moving, structural forces which may not be observable day to day. Chief amongst these is Switzerland’s structural balance of payments disequilibrium, by which we mean the combination of an excessive current account surplus and inadequate private sector capital outflows to recycle the surplus. This disequilibrium has become more acute over the past year resulting in upside pressure on the franc.

Trade tips: CADCHF 6m IV skews are stretched for downside risks (bids for OTM puts are having higher demand), which means hedgers’ sentiments are more positioned for downside than the upside risks. While same has been the case with USDCHF, both OTM puts seem more superior than the OTM calls. We also continue to be positioned short CAD via a long-held CAD put/CHF call vs. USD put/CHF call option spread (spot reference: 0.7480 and 0.9915 levels respectively).

Stay long in 6M 0.70 CADCHF put option vs short 6M 0.9450 USDCHF put at zero cost. Courtesy: Sentry & JPM

Currency Strength Index: FxWirePro's hourly CHF spot index is flashing at -18 levels (which is mildly bearish), while hourly USD spot index was at 13 (mildly bullish) and CAD is at 93 (bullish) while articulating at (10:33 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data