Euro bears have wiped out the last 3-4 days gains, EURUSD slid -0.10%, EURJPY plunged -0.61%, currently trading 117.802 levels. Our shorts in EURJPY have been activated and functioning as desired. Covid-19 was the factor that triggered the repricing of FX volatilities, after several years spent in a semi-lethargic state, with all-time lows reached just a couple of months back. With the rebound in equity indices and with FX vols taking a leg lower investors are asking about opportunities in the FX vol space for fading elevated risk premia but without taking excessive risk. One such opportunity is binary ranges that importantly have defined downside thus allow fading elevated vol premia while granting attractive risk/reward profiles.

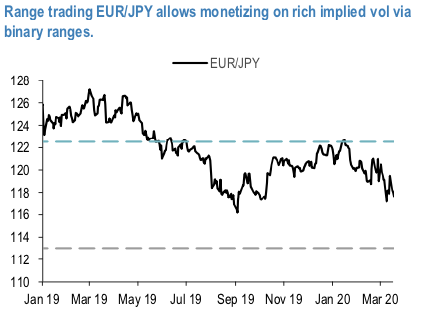

EURJPY tops the list of the liquid pairs that offer ex-ante risk/reward metrics in particular thanks to the sharp rebound in implied vols as spot remained in a tight 5% range over the past 10 months. Also, while in general binary ranges are long smile convexity, the move in EURJPY and other JPY- crosses butterflies has been more contained than for instance USD pairs, offering an attractive entry point from this angle as well. A 20% TV binary range (i.e., a trade with a maximum leverage of 5:1 if barriers are not touched till expiry) looks attractive. We choose the strikes slightly asymmetrically in order to grant some margin in case of extended EUR weakness (refer above chart).

Hence, we recommend buying 3M EURJPY binary range, barriers at 112/121.5 at EUR 17.9%/20.9% indic (spot reference: 117.866).

Alternatively, we advocated shorts in EURJPY via ITM put options and also shorts in futures contracts of mid-month tenors with a view to arresting potential dips, since further price dips are foreseen we would like to uphold the same strategy. Courtesy: JPM

For further readings on our previous post, please follow below below weblink:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts