The strategy for trading EMFX encompasses a mixed bag. It is generally pro-risk through exposure to high yielders but with a modest long dollar bias by shorting low yielders that offer little value either from a carry or fundamental perspective (complete list of trade ideas in Trade Monitor). This balanced approach remains prudent.

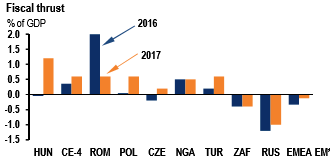

In 2017 we expect fiscal policy stances to diverge across the region; Turkey and CE-4 and should expand stimulus while South Africa, Russia, and MENA pursue tighter fiscal policy. The fiscal thrust in the EMEA EM region would be largely neutral this year; this still holds, but the country composition has changed. We now expect a looser stance in Turkey and tighter one in Russia with the consolidation effect from Russia dominating (Refer above diagram).

Risk on price action in EM FX overnight; for now (and absent a catalyst), it is hard to fight the trend especially in high yielding space. It seems like any risk premium related to Trump is evaporating and there is no longer any concern about the Fed, Chinese growth, or CNY.

Reduction in risk premium is being supported by improving fundamentals – growth dynamics improving across an EM aggregate and return on assets perking up from the mid-2016 low.

Trade recommendations:

Short SGDINR: Risks of MAS easing have decreased but no justification for SGD NEER to stay above the midpoint. Carry-to-vol super attractive; initiate/add exposure with a stop around 48.20.

Short EURTRY: Offers good risk-reward at these levels based on:

The positive EM sentiment

CBRT actions (funding, swaps)

The electoral risk in Europe.

USDRUB put butterfly: Everyone loves the RUB but positioning is heavy. Put butterfly is a good way to gain RUB exposure without losing on a correction. Asymmetric strikes provide some P&L gains if RUB strengthens a lot.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis