In the euro area, the ECB minutes from the June meeting are set to be released today.

Policy meeting would be scoured for confirmation that officials are moving towards the further stimulus. The ECB pushed out its rates guidance to mid-2020 for the earliest increase, but President Mario Draghi revealed at the press conference that several members raised the possibility of rate cuts and a restart of QE. Recently, at a forum in Sintra, Draghi was more forthright in expressing his view that “further cuts in policy interest rates and mitigating measures to contain any side effects remain part of our tools.”

At the press conference, Draghi stressed that the governing council (GC) discussed several options at the meeting including a rate cut and a restart of QE. Draghi in his Sintra speech sent a strong signal to markets that more stimulus is coming. Hence, markets will look out for clues in the minutes on how ready the GC stands in announcing immediate steps already at the 25 July meeting. We still lean towards an announcement of an easing package coming in September. Earlier in the day, ECB's Coeuré will be speaking about 'Inflation expectations and the conduct of monetary policy'.

OTC Outlook:

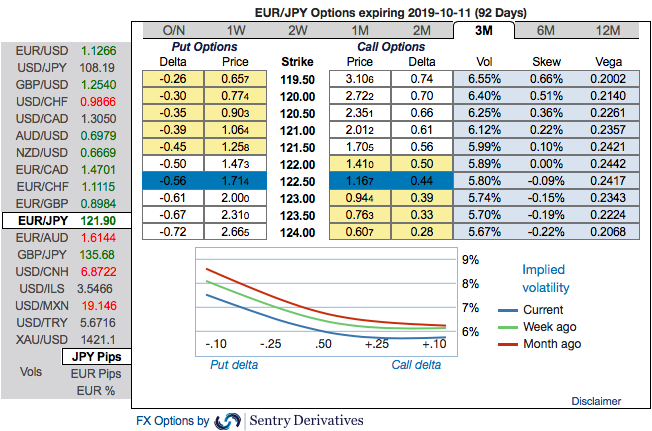

Hedging skewness (EURJPY): Please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 119.50 levels so that OTM instruments would expire in-the-money.

Risk reversals Substantiate Skews (EURJPY): Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Options Trade Recommendation (EURJPY): We’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Alternatively, we advocate shorts in futures contracts of mid-month tenors with a view to arresting potential dips. Source: Sentrix and Saxobank

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts