At the request of Prime Minister Boris Johnson, Queen Elizabeth II will prorogue Parliament from 9th September at the earliest and 12th September at the latest. On 14th October Parliament will then resume a new session with the Queen’s Speech. Initially, Sterling eased significantly but was able to recover slightly intraday. At first glance, the latter might surprise, as the step, which critics have branded a “constitutional outrage”, shortens the time MPs have to prevent a no-deal Brexit. However, just like everything else in the Brexit process, things are not as easy as that.

That is partially due to the fact that Johnson is keeping his cards close to his chest. It remains completely unclear what he is trying to achieve with this constitutionally contentious steps. Of course, nobody believes that he is taking the step merely for reasons of domestic policy, regardless of the imminent Brexit, but a GBP positive interpretation is possible.

For GBP bulls that means: the path towards a GBP positive outcome over the coming two months remains extremely rocky and the space available in the Daily Currency Briefing is too limited to list everything that could go wrong. Due to the high risk of things going wrong, we, therefore, see further depreciation potential for Sterling.

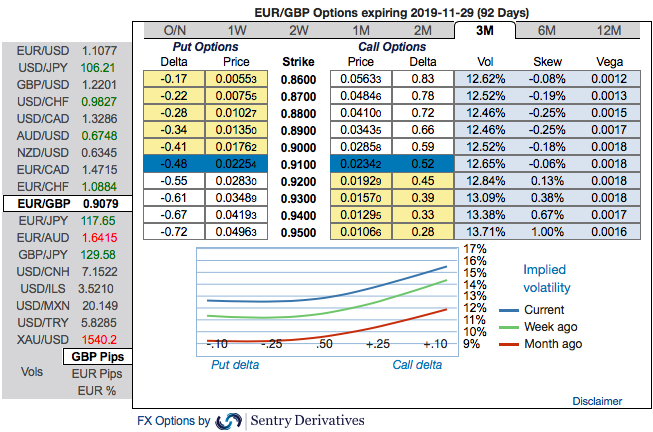

However, it is also clear that a glance at the implied volatility levels on the options market illustrates the following (refer above chart): The uncertainty as to which the direction Sterling is going to move into is considerable, unless it is completely certain which way Johnson and his adversaries are going to take over the coming weeks. The positively skewed IVs of this pair clearly signal further upside risks.

The pound is rising because the market hopes that Labour leader Jeremy Corbyn will be able to prevent a no-deal. Yesterday, he met with other parties of the opposition in order to find common ground. There were assurances of cooperation, e.g. by means of legislative proposals or a vote of no confidence. The market reacting in a pound positive way to the oppositions’ meeting shows just how desperately it is hoping for a happy ending.

But the risk of a no-deal is still very real. Parliament returns from summer recess next week and the nerve-racking battle about a soft Brexit will go into the next round.

Like most mortals, we have no insight on how the long-running Brexit drama will resolve. All we can say with a degree of confidence is that should the UK crash out of the EU without a deal, currency markets stand a good chance of directionally reprising the price patterns observed in the aftermath of the 2016 referendum.

EURUSD dropped 1.5% in the 3-months following the shock result and a more substantial 8% in 6-months; EURGBP climbed north of 10% over this period, much of it on the day of the vote; and the realized correlation between the two fell to as low as -90%.

Yet EURUSD vs EURGBP 3M implied correlation today is marked at +14%, Euro has an independent bearish catalyst at play in the form of potentially ECB easing including

QE in September and the pricing of bearish Euro options is sweetened by multi-year highs in the forward points.

Consider the following as no-deal Brexit trade: 3M (EURUSD < 1% OTMS, EURGBP > 2% OTMS) costs 11% (individual digitals 26% and 34.7% respectively). Courtesy: Commerzbank & Setrix

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes