Ever since the low-likelihood threat of a US government shutdown became reality earlier in the year, our macro team has worried about another President Trump vs. Democratic House confrontation upending what was considered to be routine Congressional ratification of 2018's USMCA trade agreement. Last week’s FX Markets Weekly noted that the administration is minded to complete the process by August, but this compressed timeline could put the President on a collision course with House Speaker Nancy Pelosi sooner rather than later. Risks are that Trump actually withdraws from NAFTA 1.0 as a negotiating tactic in order to force the issue with the House – an option he and ranking members have been vocal about – leading to punitive sell-offs in CAD and MXN.

Perhaps because of the comatose state of currency markets at present, CAD option risk premia appear oblivious to the fallout of this high stakes standoff. EURCAD risk- reversals, in particular, appear too complacently priced: at zero across the curve, they are well discounted to already low USDCAD risk-reversals (3M 0.35, 1Y 0.7), and underpriced relative to even tepid recent realized spot- vol correlations (SABR implied 6M spot-vol corr. in EURCAD r/r 1% vs. trailing 1-mo spot-vol corr 15%).

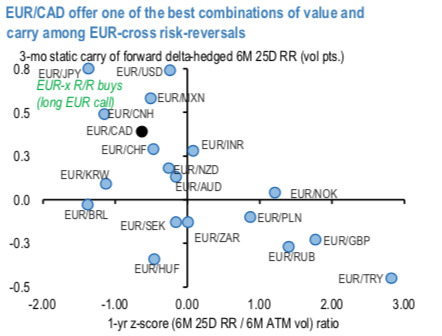

Aside from the flatter term structure that helps to extend option tenors without incurring much roll cost, the principal advantage of EURCAD riskies over USDCAD is their substantial positive carry when bought in delta-hedged format. Unsurprisingly, the source of this carry is elevated.

Euro forward points: close-to-zero risk-reversals incur very little time decay on a naked basis, while the forward delta- hedge (short EURCAD forward) earns substantially more interest rate carry. The net result is that delta-hedged EURCAD riskies are meaningfully positive carry instruments, in contrast to USDCAD riskies that incur both negative smile theta and negative points carry on the delta hedge on account of higher US rates than Canada’s. Since high Euro points are the principal driver of this carry advantage in EUR-cross risk-reversals, the skew vs. forward carry disconnect exists to varying degrees across the entire EUR/high-beta FX universe and is not limited to EURCAD; the latter only stands out on valuation screens because of their eye-catchingly depressed skew levels (refer above chart). The chart shows that EURMXN riskies are also almost equally well-priced, and present an even bigger skew vs. forward point disconnect than EURCAD; they can be particularly useful overlays on Mexican bond longs that are well represented in most global bond portfolios. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 54 levels (which is bullish), hourly USD spot index was at -41 (bearish) and CAD is at -87 (bearish), while articulating at (12:03 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis