Loonie has constantly been gaining despite today’s minor price drops amid July hike hopes that still stays alive. The unexpected strength of the Canadian economy in April, continuing the strong monthly GDP prints for February and March, has provided further support for an increase in BoC hike expectations at its 11th July meeting. With the market now pricing nearly 90% probability of a 25bp hike at that meeting, we believe risk-reward is now shifting to a move higher in USDCAD.

In recent comments, BoC Governor Poloz reaffirmed that the economic “big picture” of robust growth and on-target inflation is consistent with a continued withdrawal of stimulus.

However, further action from the BoC remains dependent on both a continuation of better data and low economic risks, such as related to trade and housing.

Whereas the recent data have shown some signs of improvement, economic risks, particularly related to trade have increased with tit-for-tat measures by the US and Canada with regards to steel and aluminum tariffs. Canadian steel and aluminum exports to the US amount to about 0.8pp of Canadian GDP. Although our baseline expectation remains for a BoC rate hike in July, the risks for an on-hold decision appear more meaningful to us than priced in by markets currently.

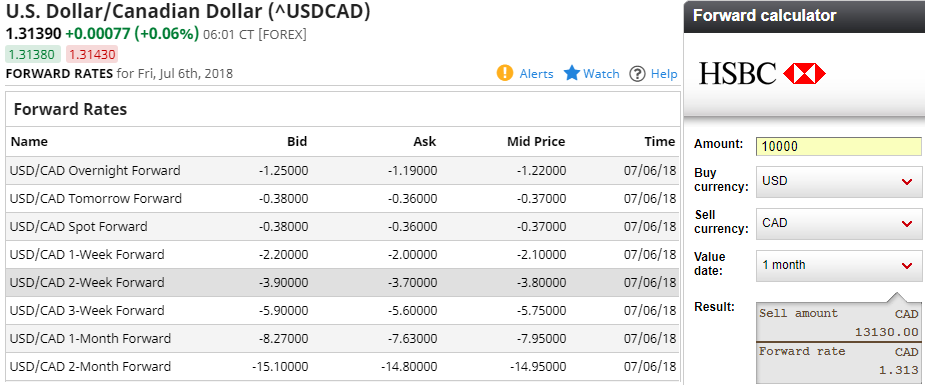

As shown in the above diagram, bearish bids for USDCAD FX forwards assist foreign traders mitigating the potential risks for US importers who have CAD payables to lock-in the future exchange rate and date on which they are expected to make foreign exchange transaction. Thus, by using these bids of FX forward contracts, investors can:

Protect costs on products and services purchased abroad, protect profit margins on products and services sold abroad and locks-in exchange rates as much as a year in advance

Hence, we advocate staying short in 1m USDCAD forwards with a view to arresting potential bearish risks in the near-term and those who have USD exposure in next 3 months or so, should add longs in 3m forwards. Courtesy: Barclays

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -72 levels (which is bearish), while hourly USD spot index was at -52 (bearish) while articulating at (11:36 GMT). For more details on the index, please refer below weblink:

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential