The Bank of Thailand (BoT) has kept its benchmark interest rate unchanged at the monetary policy meeting held Wednesday, in a unanimous decision by all members of the board. This is the 14th straight policy meeting where the central bank has kept its stance unchanged.

The BoT maintained its benchmark rate at 1.50 percent today, a move unanimously expected by all 22 analysts surveyed by Bloomberg. The central bank has kept its policy rate steady since May 2015.

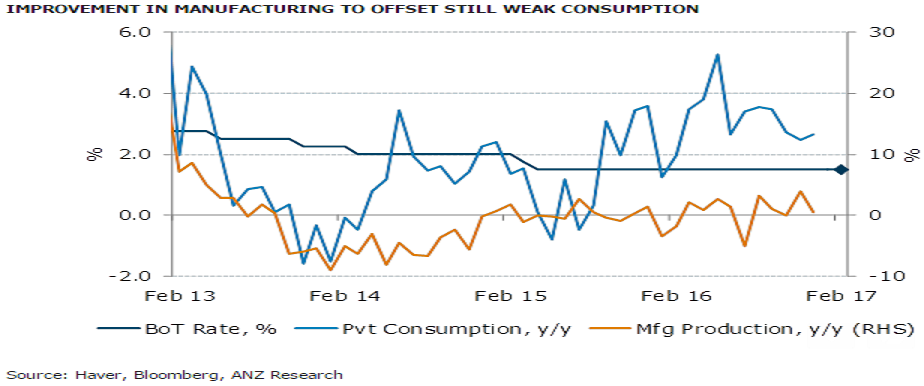

The quarterly improvement in manufacturing production in Q4 likely provided a buffer to GDP growth. While the annual growth numbers in manufacturing are still soft, it is in line with the nascent recovery in export numbers.

However, private investment remains a drag on growth. The private investment index has been posting annual contractions for the past six months despite some improvement in the construction and equipment sub-indices. Meanwhile, credit growth eased to 3.2 percent y/y in December.

Also, domestic demand remains weak amid tepid credit growth and still contracting private investment. The credit conditions survey points to banks’ concerns over loan quality. Loan officers expect further tightening in banks’ credit standards in Q1 2017, which could keep private investment weak in the medium term.

"The BoT is unlikely to use interest rates to address their concern about the baht being too strong. We still see room for the central bank to keep its policy rate accommodative at 1.50 percent through 2017," ANZ said in its latest research report.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran