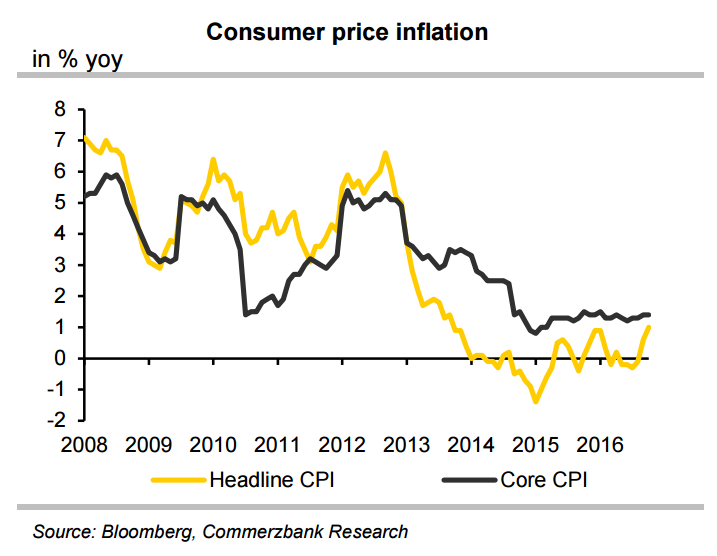

Hungary's inflation outlook is far more benign than in past years. The central bank (MNB) lowered its projections significantly through 2016. The 2016 headline inflation forecast was lowered from 1.7 percent to 0.5 percent and core inflation from 2.4 percent to 1.5 percent. MNB forecasts core inflation to accelerate to 2.9 percent in 2017. But Commerzbank noted that there are still downside risks to the central bank’s inflation forecasts.

"We are sceptical that inflation will really accelerate by this much. Core inflation has accelerated only slightly during H2 2016 and is unlikely to surpass 2% until late 2017," said Commerzbank in a report.

Data released by Hungary's Central Statistical Office (KSH) earlier on Thursday showed Hungary's inflation for the month of October rose to 1 percent y/y, a 3-year high. Core inflation came close to the expected average for this year at 1.4 percent in October, compared to the corresponding month a year earlier.

Hungary’s inflation swung back to positive territory in September following four successive months of deflation. The October inflation data shows a clear upward trend. Reading strengthens hopes of a significant recovery in the headline data, which will support the Hungarian Central Bank's pledge to hold benchmark interest rates unchanged.

“Though inflation is still far away from the central bank’s target of 3% and may be considered low in absolute terms, the upward trend has become clear,” the CIB analysis says. “Inflation was 1.4% y/y in September 2013 and this October’s figure is the first to touch 1% since then. Nevertheless, according to our calculations, annual average CPI may be close to 0.5%, i.e. the October figure does not alter this year’s outlook. Also, we do not expect any shift in the monetary policy outlook.”

The MNB cut its benchmark rate down to 0.9 percent during 2016 but has signalled that the easing cycle is finished. However, MNB continues to ease policy in a broader sense. The central bank has halved bank RRR during Q4 2016 and has also recently extended its cheap lending scheme for SME’s by another six months. The MNB will maintain a relatively looser monetary stance when compared to the ECB, which along with generally negative EM sentiment will likely lead to faster HUF depreciation over the coming year. Commerzbank sees EUR-HUF at 320.00 by H1 2017.

EUR/HUF was trading at 314.14 at 1200 GMT, up 0.33 percent on the day. USD/HUF was up 0.02 percent at 291.214. FxWirePro's Hourly Currency Strength Index at the same time was as follows: EUR Spot Index was at 86.7614(Slightly bullish), USD Spot Index was at -12.8735(Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure

Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure  Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference

Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Oil Prices Climb as Middle East Tensions and U.S. Inventory Data Boost Market Sentiment

Oil Prices Climb as Middle East Tensions and U.S. Inventory Data Boost Market Sentiment  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand

Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand  South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target

South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target  China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order

China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order  U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum

U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum