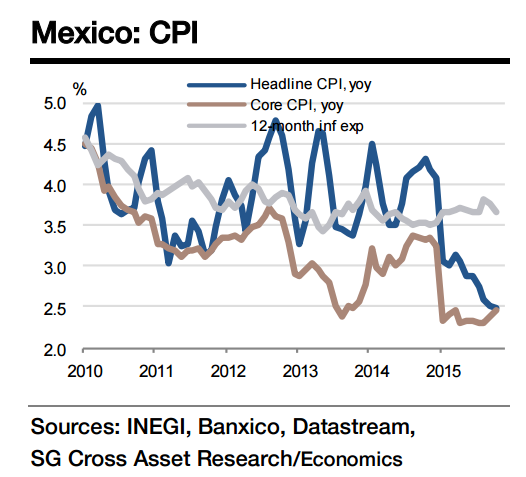

While the headline inflation rate has slipped further over the past couple of months, core inflation has moved up from 2.3% yoy in August to 2.47% yoy in October on the back of a rise in inflation in categories such as health and personal care, apparel, and furniture and domestic accessories.

Also, dwelling inflation - the key factor behind the sharp decline in inflation earlier this year - has moved up to 0.58% yoy from 0.45%. Mid-month inflation is expected to moderate to 2.47% yoy in November. In sum, core inflation has remained low, while stabilising or even rising, and the weakness in the headline inflation has been driven primarily by the food and transport segments. October and November data should hint that the deceleration (and critically, food inflation) is in last leg and that we will see it move above Banxico's target in January 2016.

Inflation should revert to its medium-term trend in 2016 when the base effect of lower telecom and energy prices ebbs. Essentially, the inflation situation remains conducive to Banxico's current accommodative stance, and growth and the Fed's stance are likely to be the key factors in monetary policy decisions over the next couple of quarters.

Mexico inflation remains low on food and transport prices; core inflation rising

Tuesday, November 24, 2015 12:32 AM UTC

Editor's Picks

- Market Data

Most Popular

China Services PMI Hits Three-Month High as New Orders and Hiring Improve

China Services PMI Hits Three-Month High as New Orders and Hiring Improve  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs

Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs  Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference

Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference