After today's second estimate of third quarter GDP, released by cabinet office, it seems things are not as dull as it seems with Japan. Today's better than expected GDP figure will provide ammunition to Bank of Japan's (BOJ) hawkish members such as Mr. Sato and Mr. Kiuchi.

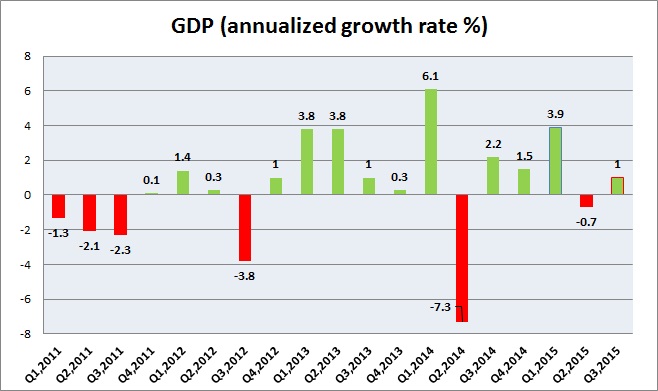

GDP grew by 1% annualized rate in third quarter, sharply in contrast to previous figure of -0.8% contraction. Economists expected improvement but just by 0.2%. With today's figure Japan is technically out of recession. Japanese economy was thought to have dropped into recession after first flash reading, which got revised today.

To add to the array of good news, second quarter GDP contraction got revised from -1.2% to just -0.7%.

To add to the good news is strong private demand.

Private consumption rose by 0.4% annualized pace and residential investment at 2%. Private non-residential investment grew by 0.6%. Exports in this flash was brighter contributor.

With improvement in both GDP and private consumption, coupled with lower than expected stimulus from European Central Bank (ECB), it looks like BOJ is likely to hold fire for now.

Yen is marginally firmer, trading at 123.1 per Dollar.

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  China Services PMI Hits Three-Month High as New Orders and Hiring Improve

China Services PMI Hits Three-Month High as New Orders and Hiring Improve  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth