In a report released by Australian Bureau of Statistics on Wednesday, Australian home loans rose to a seasonally adjusted 1.2 percent, following a revised 0.8 percent decline in May. Following this increase, loans were 6.7 percent higher than a year ago. While this reasonably firm it is well down on the 13.1 percent growth seen over the year to May.

Housing investors again drove the monthly increase in finance commitments in June. Investment lending climbed 3.2 percent to A$11.785 billion after rising 5.3 percent in the previous month. The monthly total was the largest seen since August last year, and the fourth increase in the past five months. Surprisingly, investor lending remained unaffected by tighter lending standards.

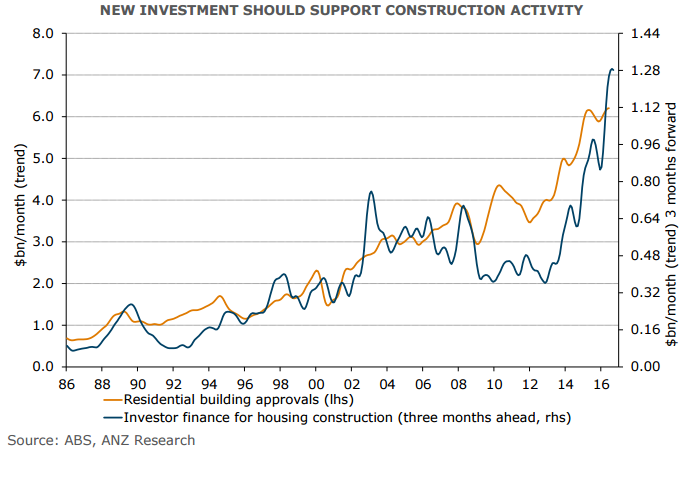

Data was a sign that investors are returning to the market, or perhaps that banks are now willing to lend to this component again following a sharp deceleration in loan growth in the second half of 2015. This strength is a positive sign for Australia's housing market and suggests that we might yet see further strength in building approvals. Along with a record backlog of work outstanding, rise in building approvals would suggest that housing construction will likely have a positive contribution to Australia's economic growth.

Meanwhile, first home owners posted the strongest monthly increase in finance commitments in a year. The number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 14.3 percent in June from 14.2 percent in May.

Loans for the construction of dwellings gained 2.1 percent to 5,856, while loans for the purchase of new dwellings climbed 2.7 percent to 2,739 and loans for the purchase of established dwellings rose 1.0 percent to 49,014. The total value of dwelling finance commitments excluding alterations and additions rose 2.3 percent to A$32.578 billion.

In a separate survey from Westpac Bank and the Melbourne Institute Australia's consumer confidence picked up steam in August as its index climbed 2.0 percent to a score of 101.0. The uptick follows the 3.0 percent decline in July to 99.1.

Aussie remained on the front foot today, AUD/USD retakes the 0.77 handle. The pair also supported by Reserve Bank of Australia (RBA) governor Stevens comments which offered no dovish surprises. The pair was trading at multi-week highs at 0.7748 as of 12:30 GMT. Techs support further gains with scope for test of 0.7775.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility