Both monetary and fiscal authorities, all around the world expressed concerns over and over again about the “Great Moderation”, post financial crisis of 2008/09, where exceptionally loose and experimental monetary policies have been used but still the growth remained subdued. Latest global trade report from CPB Netherlands Bureau of Economic Analysis shows that this trend is either likely to continue or may even falter for the worse.

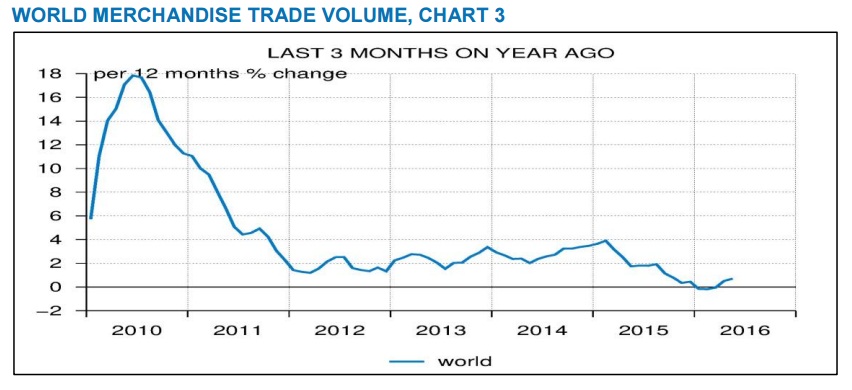

- Global trade volume shrunk in the month of May by 0.4 percent on a monthly basis that came after a decline of 0.3 percent in April. What more concerning is the fact that since 2012 (last 3 months on a year ago), global trade volume growth remained around 2 percent. While it reached as high as 4 percent in early 2015, it has declined steadily since to drop to negative in 2016. See Chart 1

- Though CPB’s Merchandise trade volume index is much higher than the pre-crisis level, it has been showing signs of erosion. See Chart 2

In terms of value, the drop has been much sharper. After declining by 1 percent in 2013, and 1.8 percent in 2014, it has declined by 13.4 percent in 2015. In the first quarter of 2016, world trade has declined by 3 percent.

Many factors had contributed to this additional downfall in past two years, namely, a sharp drop in commodities price leading to a belt-tightening by the producing countries, drop in the exchange rate of emerging economies which again led to cut in imports, and subdued recovery in the U.S., Japan, and Europe.

Uncertainties surrounding the Brexit and the fear of hard landing likely to keep on weighing over the global trade and growth.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX