The foreigners have been net buyers of EM assets (equities and bonds) for seven straight months. These trends, among other factors, have underpinned our bullish view on EM currencies relative to the forwards and consensus.

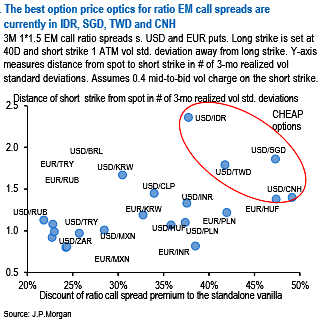

At current prices, the plot shows that USD/EM Asia is the most fertile ground for this class of trades given low vols, depressed risk-reversals spot moves suppressed by central bank smoothing of appreciation pressures.

IDR, SGD, TWD and CNH all screen as decent ratio USD put buys; CNH is the most preferred candidate of the four given a known policy dimension to aid the case of directional strength over and above pure carry considerations.

In the recent post from Goldman Sachs, they mentioned that they are cautious about the near-term outlook for the U.S. dollar in light of inflation, and likes a handful of emerging market currencies.

They also extended their lights by stating, the bottom line on our constructive view on EM FX hasn’t really changed. As we argued last month, as an asset class EM FX is still modestly undervalued on our preferred valuation metrics, and in addition, it continues to offer generous real carry (as declining inflation in many high yielders outpaces nominal rate cuts), and optionality to the ongoing upswing in EM growth. While the valuation support for EM FX is less compelling after a strong six months, the soggy inflation outturns in the United States means that the window to earn the ‘good carry’ in EM before the Fed re-injects some rate volatility may be a few months longer.

Among our ‘good carry’ candidates we see more limited scope for further spot appreciation in Russian ruble (RUB), Indian Rupee (INR) and Indonesian rupiah (IDR), which are at a more advanced stage in the macro adjustment process, and in BRL where political uncertainty remains high (even though total returns may still be handsome). By contrast, supportive valuations and improving fundamentals lead us to see more room for spot appreciation in Mexican peso (MXN), South African Rand (ZAR) and Peruvian sol (PEN). The Colombian peso (COP) would also fall into that group if oil prices can find their footing.

The above diagram walks us through a prospective structure for ranking ratio EM call spreads. Setting the long strike of 3M structures arbitrarily at 40D and the short strike 1-sigma away from the long strike (where 1-sigma is 3M ATM vol), the graphic maps the universe of USD-and EUR-EM crosses on two dimensions - the discount of the ratio construct to the long strike vanilla (X-axis) and the distance of spot to short strike as measured in number of 3m realized vol standard deviations (Y-axis); larger the two numbers, more appealing the ratio trade, as per JP Morgan.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis