The current price action in the euro remains choppy but essentially range-bound. The trade-weighted index gained 2.5% in the month to mid-September on what seemed like a re-think of the euro’s exposure to Turkey, but then gave back around 1.5% over the past few weeks as Italian stress came to the fore and the dollar was buoyed by the re-think of Fed policy. Over the past 24 hours the euro has turned higher once again as equities have slumped as this has caused a de-risking of the (small) short EUR positions the spec market had established over Italy.

Looking through the month-to-month gyrations we are holding our forecasts steady this month. The end- 2018 projection for EURUSD is modestly lower (1.130) and predicated on a combination of 1) continued divergence in near-term macro-economic momentum between the US and the Euro area and 2) probable further tensions over Italy’s budget if, as seems likely, this is rejected by the EU Commission. The possibility that the BTP spread could overshoot towards 400bp and in turn de-stabilise banks justifies downgrading the risk bias around this forecast from bullish to neutral.

Beyond that, we continue to expect a progressive but nevertheless shallow uptrend in EURUSD through next year to 1.19 to reflect 1) a closure of the growth gap between the US and Euro area from 1.5% so far this year, and 2) a probable improvement in rate spreads in the euro’s favour as the ECB delivers rather more tightening than the curve prices. We continue to believe that delivery of early stage ECB tightening should be more impactful for FX than an extension of late-cycle Fed hikes as the market is liable to become more concerned about the longevity of the US cycle if the Fed is confronted.

After Italian spreads (10 year against Bunds) had climbed to 340bp on Friday morning they collapsed back to 300bp again. Only because EU Commis- sioner Pierre Moscovici seemed to find conciliatory words and explained the EU Commis- sion did not want to influence the economic policies of the Italian government. The euro also recovered in line with the Italian spreads.

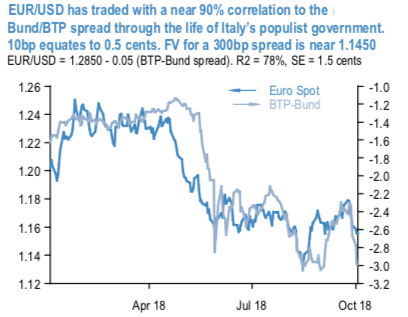

There has been an impressive degree of co-movement between EURUSD and the Italian risk premium ever since the previous Italian parliament was dissolved last December. The correlation through this period is close to 90%, dominated of course by the fraught period following the election in March as investors came to terms with an implausible coalition of populists and the euro sank by nine cents and the Bund/BTP leapt by 175bp (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 36 levels (which is mildly bullish), while USD is flashing at 58 (which is bullish), while articulating at (08:15 GMT). For more details on the index, please refer below weblink:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data