The major event in this week’s UK economic calendar is the BoE’s MPC meeting that is scheduled on this Thursday. Whilethe political and economic backdrop remains momentarily constructive of sterling’s underperformance. Nevertheless, we continue to be short, using near-term upswings by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike.

There is very little intrigue this time – having raised Bank Rate to 0.75% at the start of last month, policy makers will refrain from making further changes to current policy or their forward guidance.

The recent economic data have been broadly consistent with the BoE’s updated economic projections published last month – although July’s CPI was a touch below its forecast – and so they will maintain their expectation that further policy tightening over the forecast horizon will be required in order to return inflation sustainably to the 2% target.

Perhaps the most interesting detail about the meeting is that it will be the first one attended by newly appointed external member Jonathan Heskel, Professor of Economics at Imperial College London, who has replaced the hawkish Ian McCafferty on the MPC.

Looking at GBP against a UK data surprise index, the British currency has not paid much attention to the improvement in UK data since June, weighed by other factors including Brexit. As such, any rally in response to strong data is likely to be relatively short-lived, with the resumption of Brexit discussions on Thursday to guide sentiment.

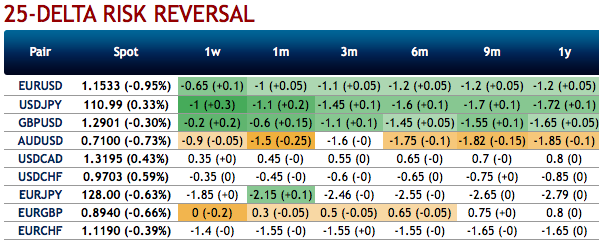

Yes, among G10 FX universe, the attention of the likelihood of a ‘no deal’ issue is keeping Brexit risks front and centre, and has taken a toll on the pound remarkably: GBPUSD has shed 2.2% MTD after the near 3% decline since early June, GBPUSD 1Y ATM vol has risen, gained 1.2vol pt since July and 1Y 25D risk-reversals have broadened to levels last seen early last year. We discuss hedging breaks below.

While the loudness of ‘no deal’ Brexit likelihood has intensified in the recent past, following International Trade Secretary Liam Fox’s pegging the odds of such a scenario at 60% in an interview. It is reckoned that the consequences of a no deal outcome are too fraught for it to be a serious policy consideration, however, continued media coverage of the issue is keeping Brexit risks front and centre of investors’ radar.

Before we proceed further, let’s just quickly glance through the hedging outlook in FX OTC markets and formulate strategies.

Please be informed that the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.20 levels.

While the positive shift in delta risk reversal numbers (across 1-3m tenors) indicates mild recovery is anticipated in the underlying movements amid the bearish hedging activities for the downside risks remains intact in a medium-term perspective.

One could argue that GBP vols and risk-reversals have not kept pace with the trend increase in political risks in the UK since the Brexit referendum. Considering 1.20 on GBPUSD to be the hard Brexit threshold – not unreasonable since 1.20 is the spot low in the aftermath of the Leave vote in 2016 – pricing on 1Y 1.20 strike GBP put/USD call digital options of 15.7% of USD notional (mid) at current market (1.2776 spot reference) strikes us as being on the low side, on net indicating that option markets assign more than 50% additional probability to a benign resolution to UK/EU. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 142 levels (which is bullish), while hourly USD spot index was at -52 (bearish) while articulating (at 08:28 GMT). For more details on the index, please refer below weblink:

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation