Risk sentiment in FX markets has begun on a soft note with most Asian equity markets moving lower overnight as trade concerns resurfaced. US President Trump has announced his intention to continue with the latest tranche of tariffs on Chinese goods, although a 10% hike as opposed to 25% is now likely. An announcement is expected over the next couple of days.

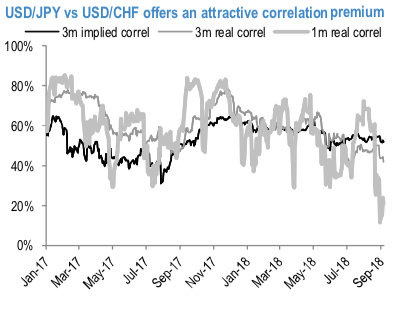

This write-up emphasizes the short dollar correlation trades owing to the weakening USD trend. Of late, the marked appreciation of the US dollar against DMFX peers has shrunk away its traction in April-May and August, with the latest sell-off in the EMFX space having so far little impact on G10 currencies/vols. The triplet USD, JPY, CHF offers an appealing prospect for fading elevated USD correlations, on the back of a weaker long- USD trend. Implied correlation for the 3M maturity currently stands at 52%, quite elevated if compared to realised correlation (3M at 44%, 1M at 21%), which has already started falling since mid-August (refer above chart).

Yen’s recovery by year-end is foreseen, (107 Dec 18 spot target for USDJPY vs current 111.3), while a modest drop in the Swiss Franc (1.00 Dec 18 spot target for USDCHF vs current 0.97), a scenario which would be consistent with weak realised correlation for the two Dollar pairs.

Predominantly, three approaches have been contemplated for shorting USDJPY vs USDCHF correlation.

Primarily, the correlation swaps propose the most direct implementation of a short correlation view. Zero tracking error, coupled with decent liquidity and contained downside risk, are the main advantages of the exotic trade: by considering the past ten years, the 5% upper quantile in the 3M realised correlation stands at 72%, just 20 correl points above the current implied level. The 5% lower quantile, at -3%, would highlight an attractive risk/reward to the correlation seller. Most interestingly, the average value of 3M realised correlation in the period 1 September 2008 – 31 March 2009 has been just 38%, indicating that the correlation has not reached extreme levels during major market sell-off episodes. Clients can enter a short 3M USDJPY vs USDCHF correlation swap at a strike of 43%, including costs.

A secondarily, the execution contemplates replicating the exotic trade via plain vanillas, with an improved liquidity compensating for the replication error and for the need of delta-hedging. The short-correl traded could be approximated by buying CHFJPY 3M vol and selling USDJPY and/or USDCHF 3M vols. As the long USDJPY vol trade might play as an effective hedge for the ongoing US-China trade sanctions, one could structure the trade as a long 3M CHFJPY straddle vs short 3M USD/CHF vs short 3M USD/CHF straddle instead, with Vega-adjusted notionals, both legs delta-hedged.

The third possibility involves dual digitals that has the main advantage of competitive-liquidity and high- leverage that clients can rejoice.

Hence, 3M (USDCHF >1% OTMS , USDJPY <1% OTMS) dual digital is offered at 7%, vs 4.6% mid, thus offering a 14.5X max gearing. The two individual AED would cost 28.8% (mid) for the USD call / CHF put and 39.3% (mid) on the USD put / JPY call, so that the large implied correlation would allow a significant discount of 84% to the cheaper AED. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -76 levels (which is bearish), while hourly JPY spot index was at -112 (highly bearish) and CHF was at 93 (bullish), while articulating at (10:05 GMT). For more details on the index, please refer below weblink:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate