The JPY appreciation was notable in the latter half of the month, mainly due to deterioration in risk sentiments as concerns for an escalation of trade wars between the US and China strengthened. USDJPY fell below 110-level on May 8thfor the first time since late March this year. Given the JPY appreciation with unexpected deleveraging and some other developments discussed in the following, we are making modest changes to our USDJPY forecast. 2Q target of USDJPY is at 108 and pushing down further expected lows of the pair to Q3 at 106.

Next week, major central banks (BoJ and Fed) are center of attraction as they are scheduled for their monetary policies, and there is a higher-than-usual degree of uncertainty. BoJ is most likely to maintain negative rates on hold. On the other hand, markets anticipate the Fed’s meeting, scouring the tone, language and forecasts set out by the Bank for signals of a cut after a higher-than-expected jobless claims report. We expect the Fed to initiate 75bp of precautionary rate cuts this year, beginning with a 50bp reduction in July.

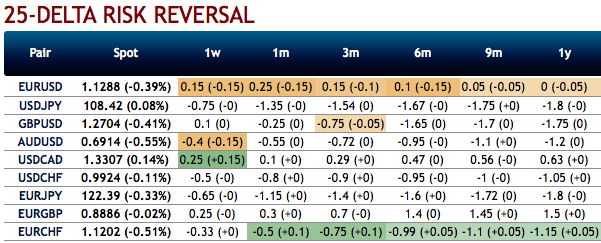

OTC updates: Bearish neutral risk reversal numbers for USDJPY indicates that there is no change hedging outlook, bearish risk sentiments are still prevailing.

Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM put of these tenors signal that the underlying spot FX likely to hit below 106.00 levels so that OTM instruments would expire in-the-money. These positively skewed IVs indicate hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand.

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run.

OTC positions of noteworthy size in the forex options market can stimulate the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Accordingly, a couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 108.220 levels, we advocate buying a 2M/2w 112/107.00 put spread ahead of Fed and BoJ monetary policies (vols 6.45 vs 6.35 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 134 levels (which is highly bullish), while hourly USD spot index was at 28 (mildly bullish) while articulating at (08:45 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation