PLN: We moved MW on euro area weakness. We recently stopped out of our bullish PLN position following disappointing euro area business surveys and further EURUSD downside but remained hedged using below options strategies.

Fundamentally, we remain constructive, believing the currency is now relatively weak compared to the resilient domestic data.

However, the scope for meaningful appreciation will remain limited until EURUSD turns higher, in our view.

CZK: Our favoured OW, holding short in USDCZK and EURCZK. We reckon that CZK remains the strongest reflation trade within CE4.

The bullish stances are driven by our expectation that CNB will surprise more hawkish and hike twice this year and by a strong basic balance of 2.6% of GDP.

The currency screens 5% cheap in our BEER model and 9% cheap in our FEER model. Data momentum is starting to turn, with downside surprises in inflation now mostly behind us. Courtesy: JPM

Derivatives Hedging Strategies:

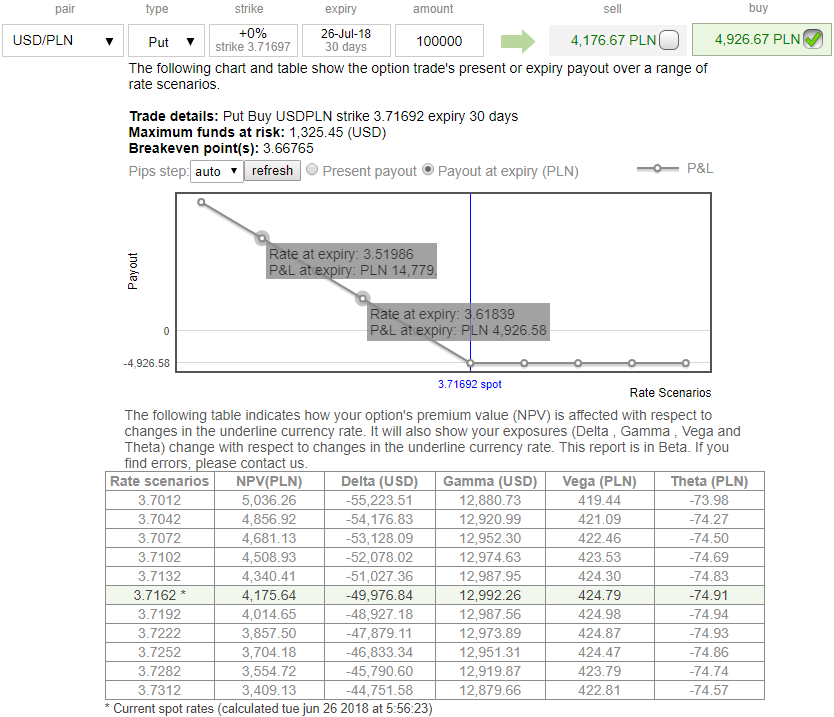

On hedging grounds, we advocate initiating longs in USDPLN and USDCZK at-the-money -0.49 delta put options of 1m expiries with a view to arresting potential bearish risks (50:50 notional, at spot reference: 3.7199 and 22.1863 levels). Delta measures the change of an option's premium with respect to changes in the currency pair exchange rate. Another way to reckon of Delta is as if it's your outright spot exposure.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -35 levels (which is bearish), while articulating (at 13:03 GMT).

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure