What is happening to the euro? All eyes are currently on the US dollar, and as a result, the single currency is taking a bit of a back seat, despite the fact that the ECB meeting is taking place next week. As is usually the case in the run-up to meetings, there is little in the way of comments by ECB officials. At least the recent comments did not result in anything unusual (the hawks hawkish, ECB President Draghi rather cautious as far as the sustainability of the rise in inflation is concerned) which the market would have to translate into a major euro move. Even though the US President continues to provide material creating movement in USD as did his Treasury Secretary Steve Mnuchin by announcing yesterday that Trump’s twitter feed about depreciation had been a “warning shot” for China and Russia.

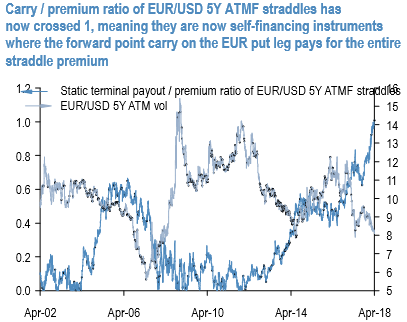

It is commented earlier on the discrepancy between broadening forward points in EUR-and EUR-crosses and relatively tame levels of vol in comparison, a combination that has resulted in an explosion in carry-to-vol ratios in these pairs.

In short, positive static carry at expiry (assuming spot remains unchanged) on the EUR put the leg of ATMF EUR straddles is sizeable enough to cover a good fraction of their premium, meaning vol ownership has become a lot less onerous from a decay standpoint than before.

This carry-to-premium ratio for EURUSD 5Y straddles crossed above the never-before-experienced threshold of 1 for the pair last week, meaning that 5Y Euro vol is now a self-financing financing asset (refer 1st chart).

Absolute vol levels are also low in a historical sense (below the 10th percentile of available history); the combination of depressed vols and high carry/vol ratios has historically been a good set-up for strategic vol ownership, especially in EM currencies.

Additionally, some of the same arguments that we made with respect to the cheapness of 5Y Yen vol apply to Euro – namely that 5Y ATM has fallen more than 1 vol and the 5Y –1Y vol slope has flattened 0.7 pts. (i.e. 5Y vol has declined more than 1Y) even when EURUSD 5Y forwards (YTD + 4.7%) have outpaced spot (YTD +2.3%) due to the well-documented decoupling between FX and rate differentials this year.

The difference with yen is that the mispricing of EURUSD 5Y vol relative to short-dated FX vol and the EUR and US swaption volatilities is not as extreme as in 2008 (refer 2nd chart) as is the case with USDJPY. In an ideal world, another 1-vol of additional misalignment would set-up excellent entry levels into outright vega longs.

In short, buying EURUSD vol with a directionally bullish Euro baseline is somewhat unexciting and lacks a bit of enthusiasm as a standalone alpha bet. Valuations are positive, however, hence there is a place for long-end EUR vega within an overall portfolio hedging context. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms