The RBA’s forecasts have been updated with the publication of the November Statement on Monetary Policy (SoMP).

The growth outlook is “little changed” and the unemployment rate is expected to fall to 5¼% by Dec 2019. Inflation is expected to be a touch lower than previously estimated, with a pick of 2% for the core measures by the end of 2019.

Despite this, the Bank explicitly states that “the assessment of pricing pressures in the near term has not changed.”

Using the RBA’s forecasts in our estimate of the Bank’s reaction function produced a projection of modest tightening cycle from 2018.

AUD was hurt by the decline in equities, falling from 0.7694 to 0.7650 against USD but partly recovering to 0.7680.

The NZD was the underperformer, despite the small hawkish surprise delivered by the RBNZ earlier, falling from 0.6980 to 0.6934 against USD.

AUDNZD ranged sideways between 1.1020 and 1.1050, preserving a 70 pip fall post-RBNZ.

While volatility remains close to all-time lows and risk sentiment is (again) at the ‘hope’ threshold, some drivers of low volatility are starting to turn.

China’s activity indicators for October are expected to show some moderation, partly due to tightening of environmental protection standards.

Options strategy:

AUDNZD major downtrend has been drifting in the consolidation phase and jerky in short run, drop to 1.0850 levels.

AUDNZD in medium-term perspective: Expect the 1.0809 area to be tested again for the day if iron ore remains under downward pressure. A retest of the 1.10 area seen in April is also possible if iron ore’s rally since mid-June continues and global risk sentiment remains elevated.

We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

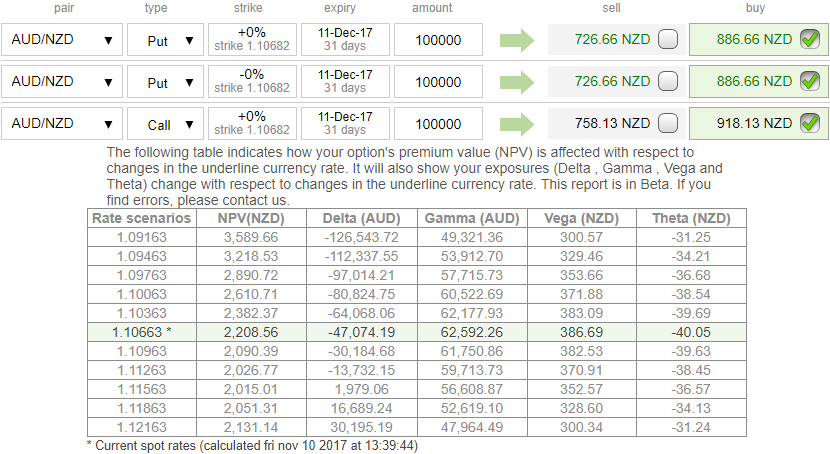

To participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). Contemplating above fundamental political developments and the ongoing technical trend of this pair. The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

The execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary