The EURCHF exchange rate has already eased back below the 1.13 mark and has therefore returned into areas that are likely to begin causing the Swiss National Bank (SNB) discomfort. SNB is scheduled for its monetary policy meeting next week.

Technically, the pair has tumbled below 1.1376 (i.e. 21-EMAs) and for now, on the verge of retracing 50% Fibonacci levels with intensified bearish momentum.

The Swiss central bank had seemed much more relaxed as regards the exchange rate when it climbed from levels around 1.10 to above 1.14 last year. Even though inflation in Switzerland is positive again, core inflation has remained at only 0.5% since the start of the year, which is anything but comfortable.

Driving forces of EURCHF:

1) Protracted EM stress and deleveraging of FX-funding.

2) Systemic Euro area stress on aggressive Italian fiscal easing.

3) The ECB delays rate hikes into 2020.

OTC updates and trade recommendations: (Short in EURCHF at 1.1392, spot reference: 1.1295 levels)

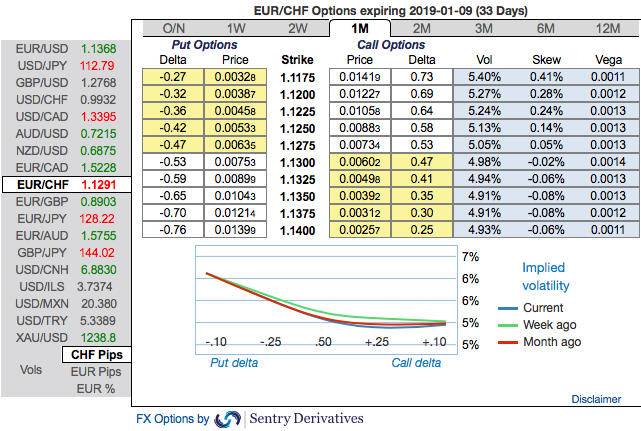

EURCHF risk reversal numbers and positively skewed of implied volatilities of 1-3m tenors signify the bearish risks to prevail further.

25-delta risk reversals indicate the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. Negative bids indicate puts are more expensive than calls (downside protection is relatively more expensive).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the in the money put with a strong delta would move in tandem with the underlying downward moves.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 102 (which is bullish), while hourly CHF spot index was at 76 (bullish), while articulating at 09:32 GMT. For more details on the index, please refer below weblink:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness