How much further will the Brazilian central bank (BCB) cut its key rate? Today it will certainly cut it by a further 50bp to then 5%. It had signalled its willingness to do so at its last meeting in September, and the conditions for further easing are given. In September inflation stood at 2.9%, i.e. at the lower end of the BCB’s target corridor (2.75 - 5.75%). Moreover following a long-winded process the much feted pensions reform was finally passed by the Senate as well last week. As a result a major factor for uncertainty, which the BCB had also constantly referred to, has been overcome and as a consequence BRL was able to appreciate over the past days.

In addition, with the major domestic political risk out of the way after the passage of the social security reform in Brazil, and the global environment expected to be relatively benign over the next few weeks, there is room for BRL vols to catch-down to the softening in the rest of the EM vol complex over the past two weeks.

We do not expect BRL to be disrupted either by proxy hedging demand in the run-up to the upcoming Argentina election, or by the postponement of the December oil auction. 1M ATM vol (12.8) is already 1 pt. lower from its local high, and we reckon that realized vol can soften to below 10% with the SSR out of the way.

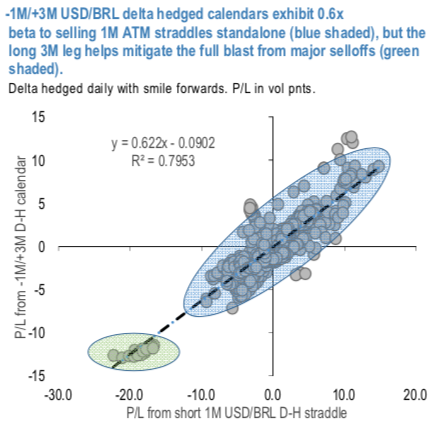

Given the flatness of the front-end of the vol curve (3M – 1M spread 0.2), we consider it prudent to quasi-hedge the outright gamma short by structuring it as a -1M / +3M straddle calendar (vega-neutral, delta-hedged).

The above chart shows that such calendar spreads capture 0.6x of the returns of standalone short 1M delta-hedged straddles on average, but the long 3M leg helps partially shield the structure from full impact of major vol shocks. Alternatively for maintenance free exposure consider 1M USDBRL vol swap @12ch vs. 1M1M FVA @12.55/13.1 indic spread, in equal vega.

Sell 1M @12.4 ch vs. buy 3M USDBRL delta-hedged straddles @12.5/12.85, vega-neutral, as a quasi-hedged outright gamma short. Courtesy: JPM

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields