Have you known the scene from the Austin Powers film where the bad guy Dr. Evil wants to hold the world community to ransom and demands one million dollars? Only when Robert Wagner points out to him that a million isn’t very much he increases his demands to 100 billion dollars? Donald Trump was in a similar situation to Dr. Evil when he asked China to reduce its trade surplus versus the US by one billion dollars. The Chinese trade surplus versus the US amounts to approx. USD 300 billion so one billion is more like a rounding imprecision.

The unintended comedy in Washington is part of a generally rather sad US trade policy that came to an initial head yesterday when tariffs on steel and aluminum imports were imposed. The relevance of this measure is not so much related to the immediate economic effect of the step but to the fact that the US appears to end the WTO consensus and could thus become the pallbearer of globalization.

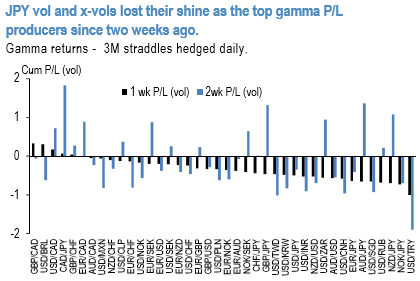

But alleviated the worst of the retaliation fears by excluding Canada and Mexico and leaving the door open for other US trade partners to be given similar exemptions. With risk on-risk off flip-flopping throughout the week gamma returns under delivered (refer 1st chart).Yet, residual risk remains of broadening tariffs, reprisals from trade partners and a disruptive finding of the China/intellectual property Section 301 probe.

Judged by a limited historical sample, bilateral trade conflicts have tended to strengthen alternative reserve assets such as the euro, yen, and gold against the dollar. They also tend to be growth negative for emerging markets that thrive on global trade, especially if retaliatory tariffs are involved.

Despite these risks, high beta currencies have so far shown impressive resilience as investors have been reluctant to turn overly bearish given above-trend global growth. The lack of many reactions from the likes of AUD, NZD, and CAD opens up opportunities to buy under-priced option hedges.

Most notably, aggregate USD-denominated implied correlations still trade near their highs from around the VIX shock (refer 2nd chart) –a set-up that is favorable for betting on the divergence between reserve and high beta currencies via short USD correlation structures.

As a result, in the recent past, we’ve already initiated a tilt towards correlation selling via triangles of short USDJPY and NZDUSD puts hedged with long NZDJPY puts.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis