We expect the Fed to hike rates by 25bps today, bringing the funds rate to 1.375%. More interesting will be the Fed’s “dot plot,” particularly the median rate outlook in 2018. In short, the dots could have a marginally dovish tilt to them if the 2019 dot slips slightly and there is greater consolidation towards the median from the above-median dots. Meanwhile, core CPI inflation may have jumped by 0.3% on the back of continued strength in components impacted by the hurricanes. That would stand in contrast to Brazil, where lower inflation, along with labor market strength, should help to strengthen consumption. FOMC to hike by 25bps, but dots might lean slightly dovish.

Gold has usually been sensitive to moves higher in both UST yields as well as the US dollar, the bullish dollar leads bullion market costlier for holders of foreign currency while a rise in U.S. rates, lift the opportunity cost of holding non-yielding assets such as bullion.

Hedging Framework:

Strategy: 2m 3-Way Diagonal Straddle versus OTM Put

Spread ratio: (Long 1: Long 1: Short 1)

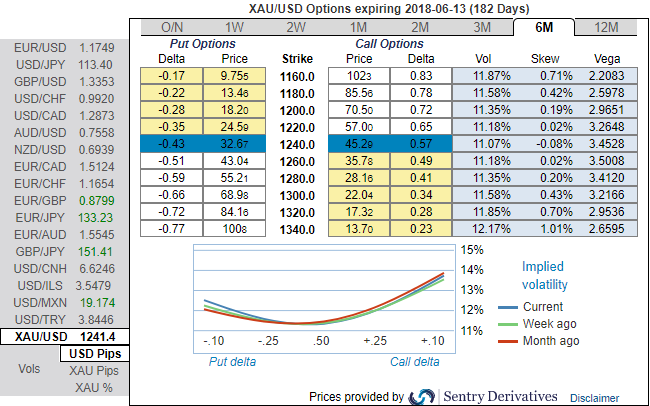

Rationale: Let’s glance at sensitivity tool, the bullish neutral risks reversals indicate upside risks in underlying spot gold prices, while lower implied volatilities with well-balanced positively skewed IVs signify the put writers’ advantages.

For 6m IV skews have been well balanced and signify the hedgers’ interests on both OTM call and put strikes. While 1m bearish risk reversals remain intact with shrinking IVs are conducive for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

While it is reckoned that as per the OTC indications as shown above and the prevailing trend in bullion markets seem to be reasonably addressed by hedging participants, thus, we advocate below option strategy to keep uncertainty in spot gold prices on the check. On trading perspective also, the strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on the downside and with cost-effectiveness.

The execution:

Go long in XAUUSD 3M at the money -0.49 delta put, and go long 6M at the money +0.51 delta call and simultaneously, Short 1m (1%) out of the money calls. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis