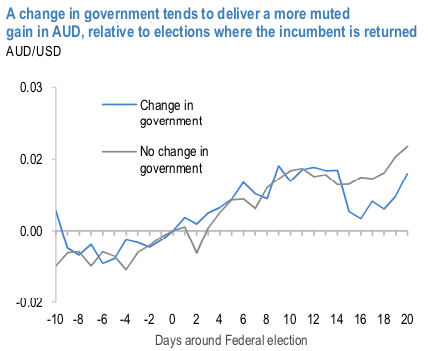

If history is likely to repeat, the Federal election in Australia could deliver a short term boost to Aussie dollar, but less so if the ALP is victorious. We find that on average, AUDUSD typically rallies 2c in the weeks after polling day, on average. But if we look at the rally in AUD depending on which party won the election, the rally when the ALP wins the election is about half that of the gain when the LNP Coalition is elected. This is likely to hold true this time around, given that some of the ALP’s policies are likely to be viewed as less market-friendly, which might act to cap any post-election relief rally in AUD. Another fact that weighs against expecting much of a post-election bounce in AUD is that on average, the market has seen a larger rally in AUD when a government is returned (+1.8c), relative to that seen when a government loses power (+1.2c); (refer 1stchart).

Nevertheless, in Australia, the RBA left the cash rate unchanged at 1.5%, contrary to our expectations of a 25bp rate cut. This outcome came despite the weak core inflation print, and it appears that a deterioration in the labor market now appears to be a necessary condition for cut, with significant uncertainty around what magnitude of deterioration (and over what time period) would trigger an easing.

Hence, even if the Aussie dollar gains abruptly, that would be momentary ahead of the above event. We will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.6650 level which is in line with the above bearish scenarios (refer 2nd chart).

Please also be noted that mounting numbers of bearish risk reversals and bearish neutral RRs of the 3m tenors that are also in sync with the bearish scenarios refer to 3rd (RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

The rationale: Contemplating all the above factors, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m shrinking IVs to optimize the strategy.

Theta shorts in OTM put option would go worthless and the premiums received from this leg would be sure profit. We would like to hold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix, JPM & Saxobank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -58 levels (which is bearish), while hourly USD spot index was at 74 (bullish) while articulating (at 06:48 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align