The CAD is soft, down modestly vs the USD while underperforming most of the G10 currencies as market participants focus on escalating diplomatic tensions between Canada and China.

The CAD’s standard drivers—oil prices (WTI) and yield spreads—are once again dominating following a period of uncorrelated movement through most of November. A reminder that the CAD also remains completely uncorrelated to the price of Western Canada Select.

Headwinds are strengthening as the price of WTI softens back toward the psychologically important $50/bbl level and yield spreads hover just below their recent highs.

The outlook for relative central bank policy is deteriorating as Fed tightening expectations recover while those for the Bank of Canada hold steady, with OIS only pricing about 20bpts of BoC tightening by May. CAD seasonals remain bearish, given the currency’s tendency to weaken into year end and base around the end of January.

The BoC will continue with its hiking cycle over the next two years, whereas the Fed will end its own cycle next year. Hence, we expect the CAD to appreciate.

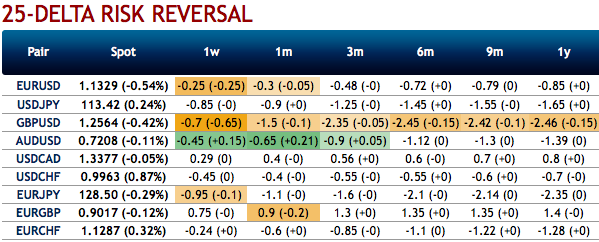

OTC indications and options strategies:

2M ATM IVs are trading a shy above 6.67% - 7.04%, skews are also suggesting the odds on OTM call strikes upto 1.36 levels at this juncture. We could also notice bullish neutral risk reversals that signals upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favour optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Thus, call spreads are preferred option structures given elevated skew and favourable cost reduction.

At spot reference: 1.3370 levels, we execute USDCAD 2m/1m call spread with strikes of 1.36/1.32 for a net debit.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader finances the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Source: Sentrix, saxobank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 13 levels (which is mildly bullish), hourly USD spot index was at 51 (bullish) while articulating at (14:04 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom