Today, the measures to combat the coronavirus in Germany will be eased for the first time. Further steps in this direction should follow. This will also shift the focus on the markets away from the extent of the slump towards the speed of recovery. The usual economic statistics will show this only with a considerable delay.

However, there are data available in the short term that can at least give an idea of whether and how the recovery is progressing.

French President Emmanuel Macron, Italy's Prime Minister Giuseppe Conte: both are in favor of corona bonds - an idea that the Dutch and German governments, among others, reject. The ECB is in favor of setting up a “bad bank” (according to press reports), the EU Commission rejects that. Everything all told: there is considerable potential for conflict at Thursday’s EU summit. That might put pressure on the euro.

In addition, Bank of Japan is scheduled for their monetary policy on 28th of this months, when adjusting for price and seasonal effects, the BoJ’s trade figures implied a similar trend in March – a drop in the volumes of exports (3.4% mom) and a surge in the volume of imports (13½% mom) following very weak demand at the start of the year.

While 10Y JGBs remained well anchored close to zero per cent by the BoJ’s yield curve control, 2Y yields were a couple of bps higher.

EURJPY’s price gains pared at 117.290 levels, the minor downtrend has been constant ever since the failure swings at the peaks of 121.144 levels.

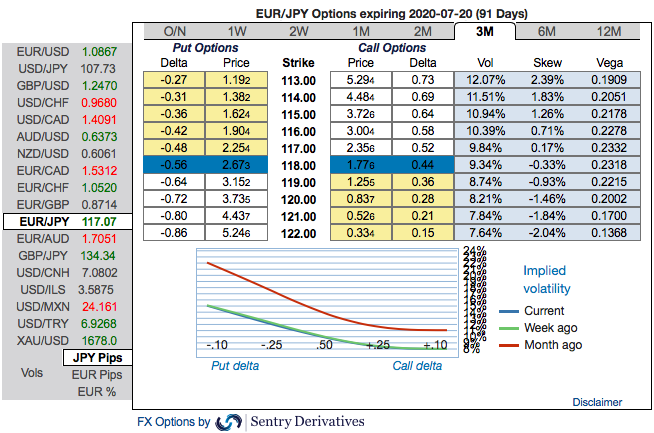

OTC Outlook: Most importantly, (at spot reference: 117.07 levels) the positively skewed EURJPY IVs of 3m tenors are signifying the bearish risks in the underlying spot (refer 1st exhibit). The bids for OTM puts indicates that the hedgers expect the underlying spot FX to show further dips so that OTM instruments would expire in-the-money (bids up to 113 levels).

To substantiate the above indications, we could see fresh negative bids in the EURJPY bearish risk reversal (RR) set-up that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks (refer 2nd exhibit). Hence, we advocate below hedging strategy contemplating the above drivers and OTC indications.

Options Strategy: Contemplating above factors and the prevailing underlying sentiments, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging as well as trading grounds as the mild abrupt upswings were contemplated earlier.

Short Hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for March month deliveries. Source: Sentry, Saxo & Commerzbank

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Thailand Economy Faces Competitiveness Challenges as Strong Baht and U.S. Tariffs Pressure Exports

Thailand Economy Faces Competitiveness Challenges as Strong Baht and U.S. Tariffs Pressure Exports  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different