The US Federal Reserve raised key interest rates by 25 basis points to between 0.50 per cent and 0.75 per cent on Wednesday in its second such hike since last December. The FOMC expects that with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will strengthen somewhat further.

Fed forecast of GDP growth next year was nudged only very slightly higher (up 0.1ppt to 2.1 percent), while that for unemployment was nudged only slightly lower (down 0.1ppt to 4.5 percent), and the forecasts for headline and core inflation were left unchanged (1.9 percent and 1.8 percent respectively). Minimal changes were made to future years' forecasts.

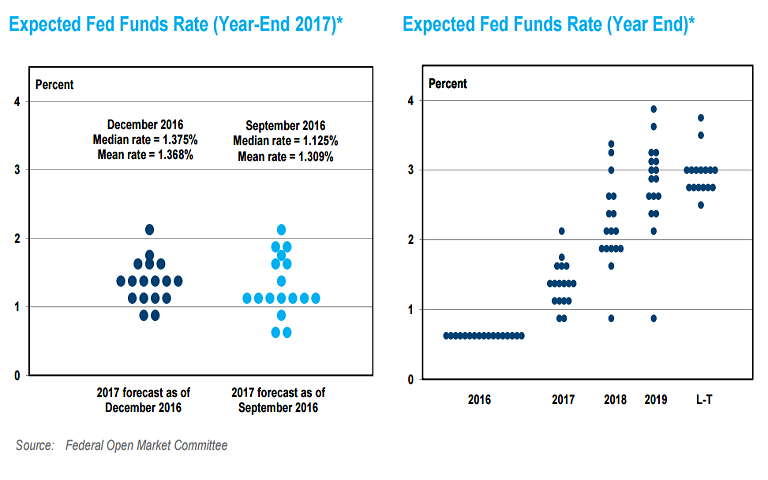

Fed's updated forecasts suggest that the FOMC hardly thinks that much has changed from three months ago. At the press conference, chair-person Yellen also noted that some FOMC members assumed fiscal stimulus over the coming year. When the Fed in December 2015 moved for the first time since the financial crisis, it projected four rate hikes in 2016, which did not materialize.

President-elect Donald Trump has pledged to cut taxes for corporations/individuals and to invest about $1 trillion on infrastructure. Trump's proposals are still uncertain, meaning that the Fed is unlikely to capture the full extent of their impact in its outlook right now. Recovery is likely to continue barring no major shock to the system. But the eventual performance of the economy is highly dependent on the still rather uncertain Trumponomics.

"We expect the Fed to hike rates slightly faster in 2018 than earlier anticipated. Overall, we expect real GDP growth of around 2% in 2017 and 2018. Risks to this outlook are significant. A more adverse policy mix including a more disruptive trade policy could lead to a significant economic slowdown. Fiscal policy, on the other hand, might prove more expansionary than we have assumed." said Nordea Bank in a report.

The USD surged higher, aligned with US yields on the back of the Fed's more than expected hawkish statement. USD/JPY surged past 118 handle to hit fresh 10-month highs at 118.66. EUR/USD plunged to hit fresh 13-year lows at 1.0405.

FxWirePro's Hourly USD Spot Index was at 156.292 (Highly bullish) at 1210 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

China Services PMI Hits Three-Month High as New Orders and Hiring Improve

China Services PMI Hits Three-Month High as New Orders and Hiring Improve  Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure

Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order

China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Japan Services Sector Records Fastest Growth in Nearly a Year as Private Activity Accelerates

Japan Services Sector Records Fastest Growth in Nearly a Year as Private Activity Accelerates  Oil Prices Climb as Middle East Tensions and U.S. Inventory Data Boost Market Sentiment

Oil Prices Climb as Middle East Tensions and U.S. Inventory Data Boost Market Sentiment  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand